To sign up to receive the latest Canadian Energy Centre research to your inbox email: research@canadianenergycentre.ca

Download the PDF here

Download the charts here

Overview

Canada’s oil and natural gas sector has a positive impact on many aspects of the Canadian economy, not only in Alberta and Saskatchewan where the industry is a relatively large proportion of the economy, but across the country. Canada’s oil and gas sector benefits the economies of all the provinces, including Ontario, Quebec, British Columbia, and those in Atlantic Canada, not only when the sector is healthy, but also in “slump” years, such as 2017, when oil and gas prices were relatively depressed.

The impact of the oil and gas sector on GDP, jobs, output, and exports on provinces outside Western Canada and on key economic sectors in those provinces is not well-known but is highly relevant to current discussions about the role of oil and gas in Canada’s future.¹

In this CEC Fact Sheet, we examine the impact that the oil and gas sector has had on Atlantic Canada’s economy.

- First, the analysis presented here includes not only the direct impact of Canada’s oil and gas sector on Atlantic Canada’s economy in terms of nominal GDP, output, jobs, and exports, but also the indirect impact that such activities have on other sectors in Atlantic Canada.

- Second, given that the largest proportion of oil and gas activity in Canada occurs in Alberta, we also profile the impact of purchases from Alberta on various sectors in Atlantic Canada’s economy. Here, we look at 2017 in isolation (the latest year for which this data is available), as well as the overall 2012-2017 period for interprovincial trade exports from Atlantic Canada’s manufacturers to Alberta.

- We also show the significant role that Alberta plays in Atlantic Canada’s interprovincial and international trade flows.

Analysis One: The impact of the oil and gas sector on Atlantic Canada

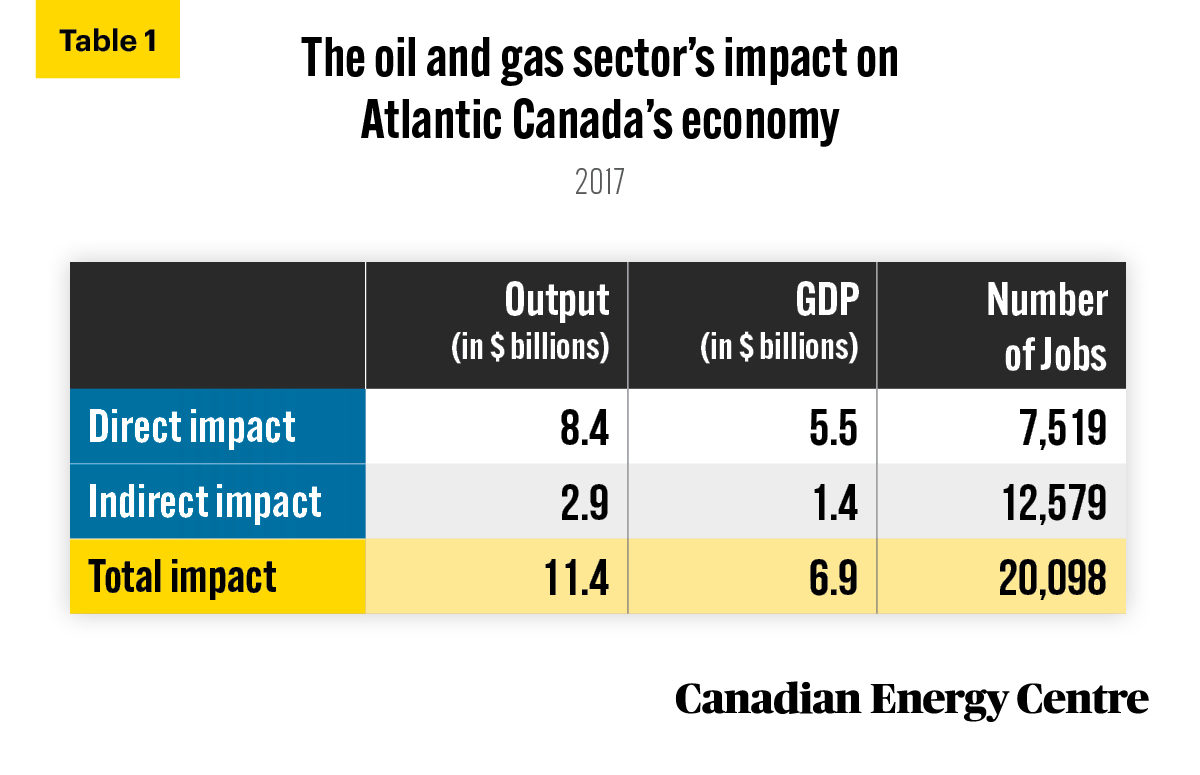

Using customized data from Statistics Canada (see Table 1), in 2017 the oil and gas sector:

- Was responsible for adding nearly $6.9 billion in nominal GDP to the economies of the provinces in Atlantic Canada;

- Generated nearly $11.4 billion in outputs,² consisting primarily of the value of goods and services produced by sectors in Atlantic Canada;

- Supported over 20,000 jobs directly and indirectly in Atlantic Canada; and

- Paid over $1.36 billion in wages and salaries to workers in the four Atlantic provinces.

1. Atlantic Canada has a long history of involvement in the oil and natural gas sector, though in recent years the main involvement has been via Newfoundland & Labrador. For more on natural gas and oil development and revenues in the Atlantic provinces, see CEC Research Brief Five: Missed Maple Leaf Opportunities: A Synopsis of Natural Gas Industries in Central and Eastern Canada and Key US States. 2. For a discussion of Statistics Canada’s use of both input/output models and equilibrium models, see the addendum in Fact Sheet #17. The latest available year for the customized data from Statistics Canada is 2017

Source: Derived from Statistics Canada, Supply and Use Tables, custom tabulation. Totals may not add exactly due to rounding.

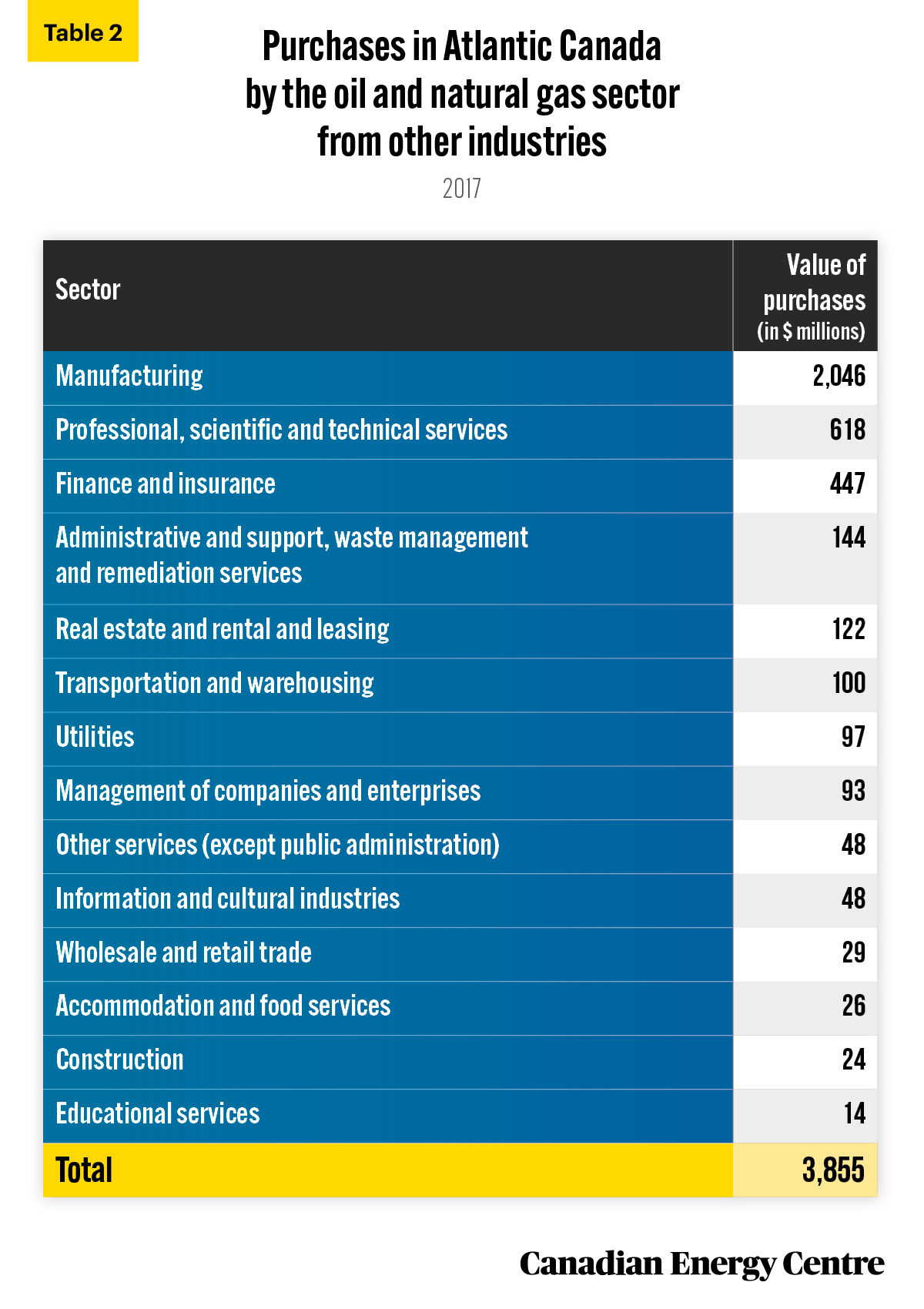

The oil and gas impact alone in 2017: $3.8 billion on key sectors in Atlantic Canada

To examine the impact of oil and gas development on the Atlantic economy in more detail, consider that in 2017, the oil and gas sector purchased over $3.8 billion worth of goods and services from other industries in Atlantic Canada (see Table 2). That $3.8 billion included:

- $447 million from the finance and insurance sector;

- $618 million from the professional, scientific, and technical services sector; and

- Over $2 billion from the manufacturing sector.

Source: Authors’ calculation derived from Supply and Use Tables, Statistics Canada catalogue 15-602-x_2017

Analysis Two: Alberta’s share of Atlantic Canada’s interprovincial trade flows in 2017: $1.7 billion

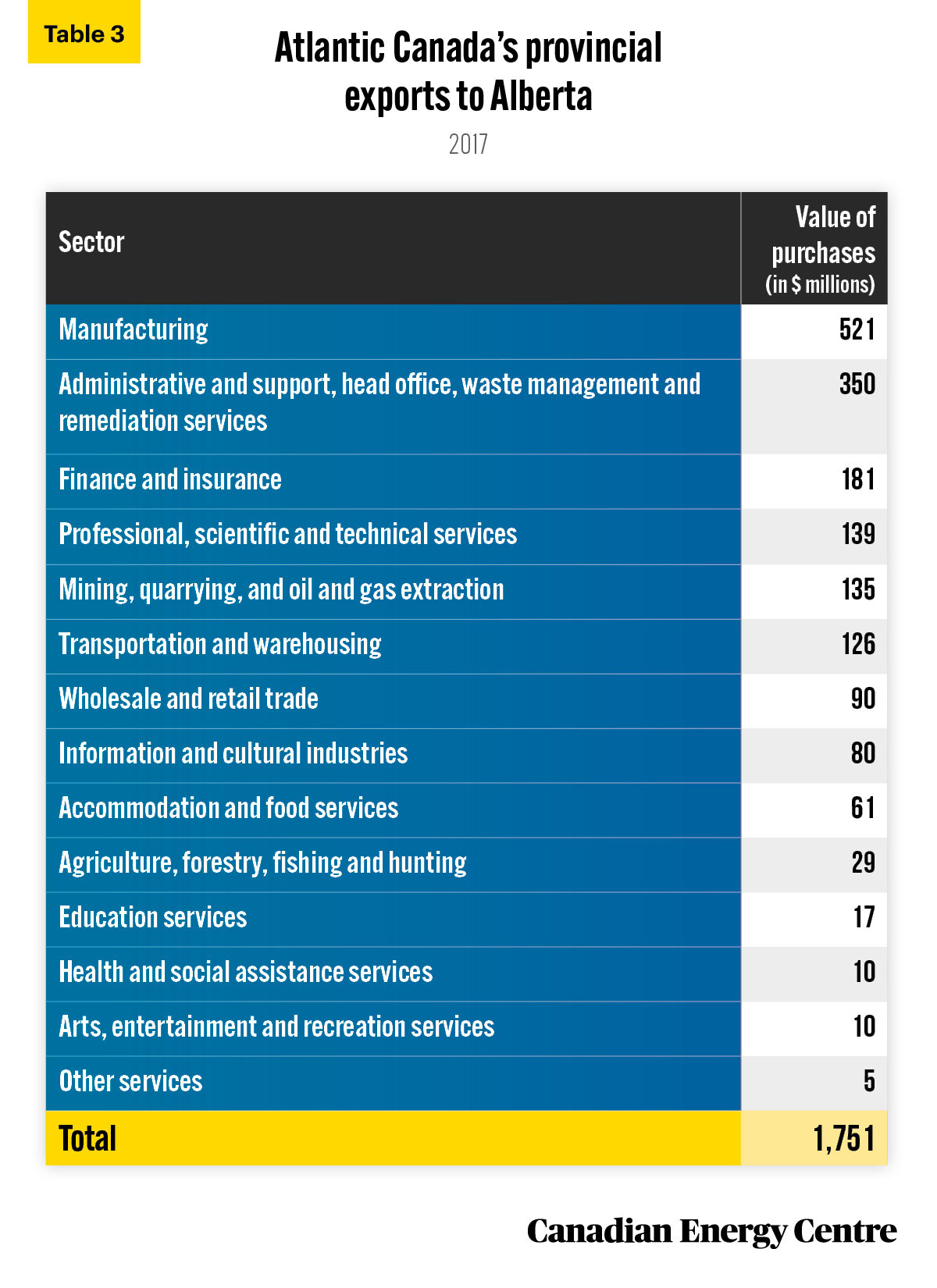

Given that the largest proportion of oil and gas activity in Canada occurs in Alberta, we have expanded the analysis to include all purchases of Atlantic Canadian goods and services by Alberta’s consumers, businesses, and governments—that is, we measure the value of Alberta’s interprovincial trade with Atlantic Canada.

Albertans spent a substantial amount on Atlantic Canadian goods and services in 2017, from relatively small amounts in accommodation and food services ($61 million) to more substantial trade in manufactured goods ($521 million). In total, in 2017 alone, interprovincial exports from Atlantic Canada to Alberta were worth over $1.7 billion (see Table 3).

Source: Authors’ calculation derived from Supply and Use Tables, Statistics Canada catalogue 15-602-x_2017.

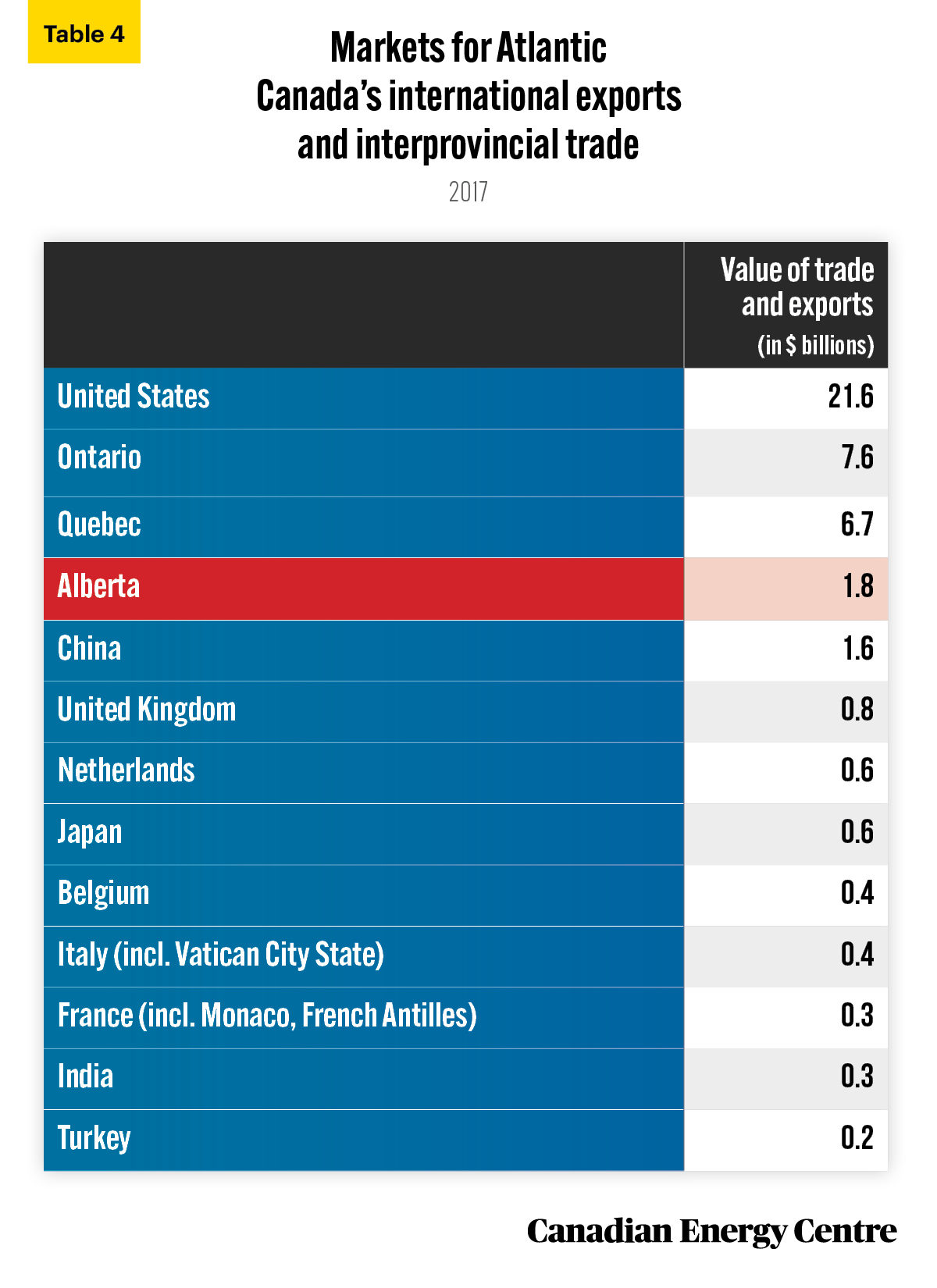

Alberta is one of Atlantic Canada’s largest markets for interprovincial trade and exports

Atlantic Canada’s interprovincial trade with Alberta in 2017 (see Table 4) was behind the region’s trade with the United States (nearly $21.6 billion), Ontario ($7.6 billion), Quebec ($6.7 billion), but ahead of trade with international markets such as China ($1.6 billion), the United Kingdom ($800 million), and the Netherlands and Japan ($600 million each).

Source: Government of Canada, trade data online, and authors’ calculation derived from Statistic Canada Table 12-10-0088-01.

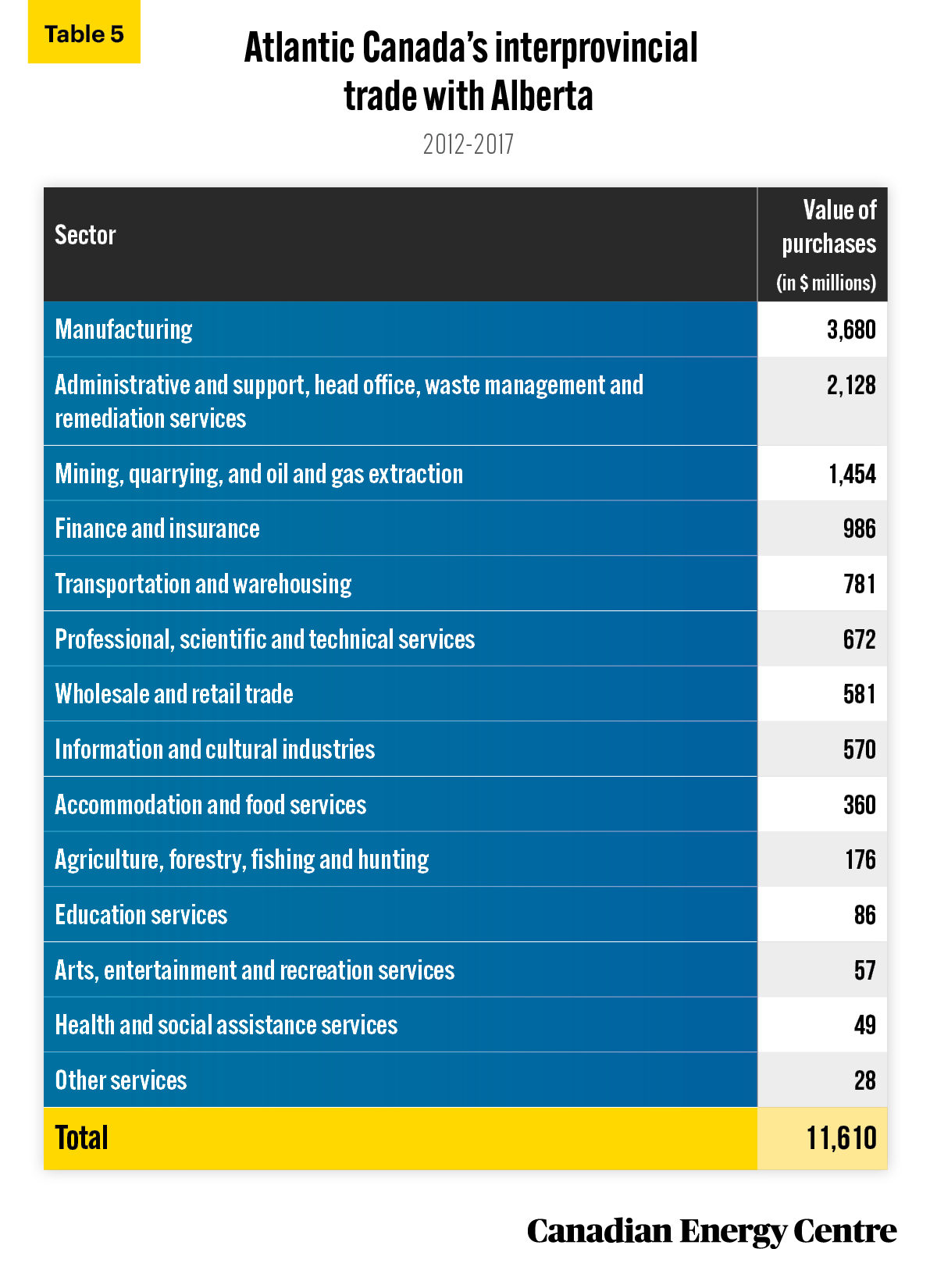

Alberta’s 2012-2017 totals: Nearly $11.6 billion

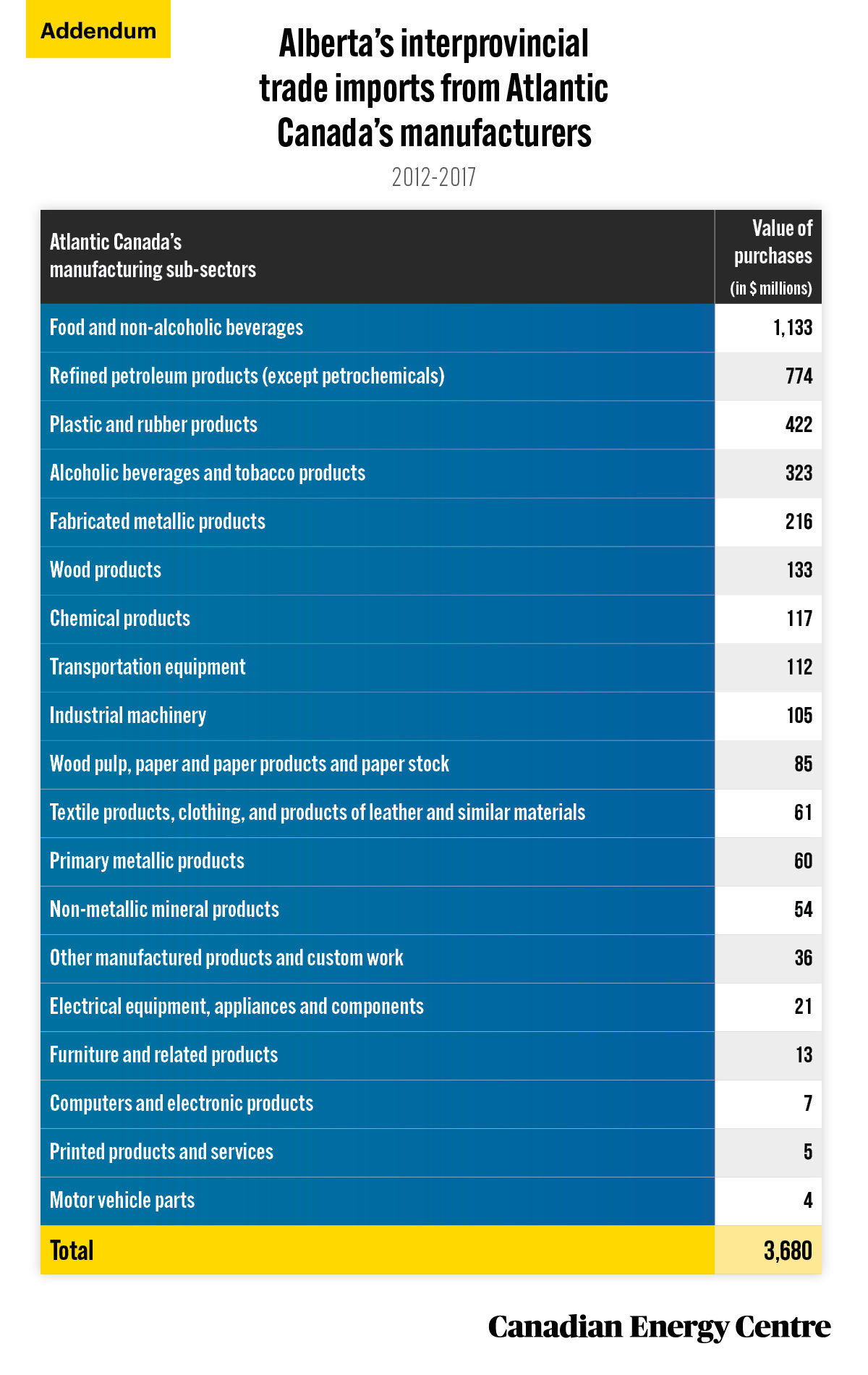

Between 2012 and 2017, Alberta imported over $11.6 billion worth of goods and services from the Atlantic provinces, ranging from the relatively smaller $86 million in education services to $1.1 billion in food and non-alcoholic beverage purchases (see Addendum) and nearly $3.7 billion in manufacturing in total (see Table 5).

Source: Authors’ calculations derived from Supply and Use Tables, Statistics Canada (various years).

The takeaway

The oil and gas sector in Canada has a significant direct and indirect impact on Atlantic Canada’s export sectors, as does the purchase of goods and services in Atlantic Canada by citizens, businesses, and governments in Alberta, the province where the oil and gas sector is concentrated. The oil and gas sector also provides substantial economic benefits to the Atlantic provinces in GDP, jobs, output, wages and salaries. More specifically, those benefits include $6.9 billion in nominal GDP, $11.4 billion in outputs, 20,000 jobs. and over $1.36 billion in wages and salaries.

Addendum

Source: Author’s calculations derived from Statistics Canada Table 12-10-0088-01.

Notes

This CEC Fact Sheet was compiled by Ven Venkatachalam and Mark Milke at the Canadian Energy Centre (www.canadianenergycentre.ca). All percentages in this report are calculated from the original data, which can run to multiple decimal points. They are not calculated using the rounded figures that may appear in charts and in the text, which are more reader friendly. Thus, calculations made from the rounded figures (and not the more precise source data) will differ from the more statistically precise percentages we arrive at using source data. The authors and the Canadian Energy Centre would like to thank and acknowledge the assistance of Philip Cross in reviewing the data and research for the initial edition of this Fact Sheet. Image credits: Erik Mclean from Unsplash.com

References (All links live as of September 30, 2021)

Statistics Canada (2020), Supply and Use Tables, 2017: 15-602-X_2017 <https://bit.ly/2XHbDUe>; Statistics Canada (2021a), Supply and Use Tables, custom tabulation; Statistics Canada (2021b), Table 17-10-0057-01: Projected population, by projection scenario, age and sex, as of July <https://bit.ly/2W8bzfN>; Statistics Canada (2021c), Table 12-10-0088-01: Interprovincial and international trade flows, basic prices, summary level <https://bit.ly/3EN0aTR>; The American Petroleum Institute (July 2017), Impact of the Natural Gas and Oil Industry on the US Economy in 2015 <https://bit.ly/2EKrJTT>; Government of Canada, Trade Data Online (October 2021) <https://bit.ly/2EMswnj>.

Definitions

The oil and gas sector is defined as the sum of oil and gas extraction and oil and gas investment. Oil and gas extraction is defined by NAICS subsector 211. It comprises establishments primarily engaged in operating oil and gas field properties. Such activities may include exploration for crude petroleum and natural gas; drilling, completing, and equipping wells; and all other activities in the preparation of oil and gas up to the point of shipment from the producing property. This subsector includes the production of oil, the mining and extraction of oil from oil shale and oil sands, and the production of gas and hydrocarbon liquids through gasification. Oil and gas investment includes capital expenditures on construction, machinery and equipment, and exploration by the oil and gas extraction industry. GDP, or Gross Domestic Product, also referred to as gross value added at basic prices, is the sum of the market values, or prices, of all final goods and services produced in an economy. Output consists primarily of the value of goods and services produced by an industry. Jobs include employee jobs (full-time, part-time, and seasonal) and self-employed jobs. The direct impact of oil and gas extraction is the effects directly attributed to the industry’s production. The direct impact of oil and gas investment is the deliveries by domestic industries to satisfy capital expenditures by the oil and gas extraction industry. Direct impact is measured in terms of GDP, output, and jobs within the oil and gas sector. The indirect impact covers upstream economic activities associated with supplying intermediate inputs (the current expenditures on goods and services used in the production process) to the directly affected industries. The indirect impact is measured in terms of GDP, output, and jobs through the oil and gas sector supply chain, including other key sectors of an economy—in the case of this paper, Atlantic Canada’s economy. We use the American Petroleum Institute definition of the oil and natural gas sector to quantify the goods and services purchased by the sector and the wages paid by the sector. The sector includes conventional oil and gas extraction and non-conventional oil extraction. Support activities for oil and gas extraction include oil and gas engineering construction, petroleum refineries, petroleum and coal product manufacturing (except petroleum refineries); petroleum product wholesaler-distributors, gasoline stations, crude oil and other pipeline transportation, and pipeline transportation of natural gas. The manufacturing sector includes food and non-alcoholic beverages; alcoholic beverages and tobacco products; textile products, clothing, and products of leather and similar materials; wood products; wood pulp, paper, paper products, and paper stock; printed products and services; refined petroleum products (except petrochemicals); chemical products; plastic and rubber products; non-metal mineral products; primary metal products; fabricated metal products; industrial machinery; computers and electronic products; electrical equipment, appliances, and components; transportation equipment; motor vehicle parts; furniture and related products; and other manufactured products.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms with attribution to the CEC. Attribution and specific restrictions on usage including non-commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial-NoDerivs CC BY-NC-ND.