To sign up to receive the latest Canadian Energy Centre research to your inbox email: research@canadianenergycentre.ca

Download the PDF here

Download the charts here

Overview

Labour productivity is a critical factor in ensuring sustained economic growth, improved international competitiveness, and enhanced living standards for Canadians.

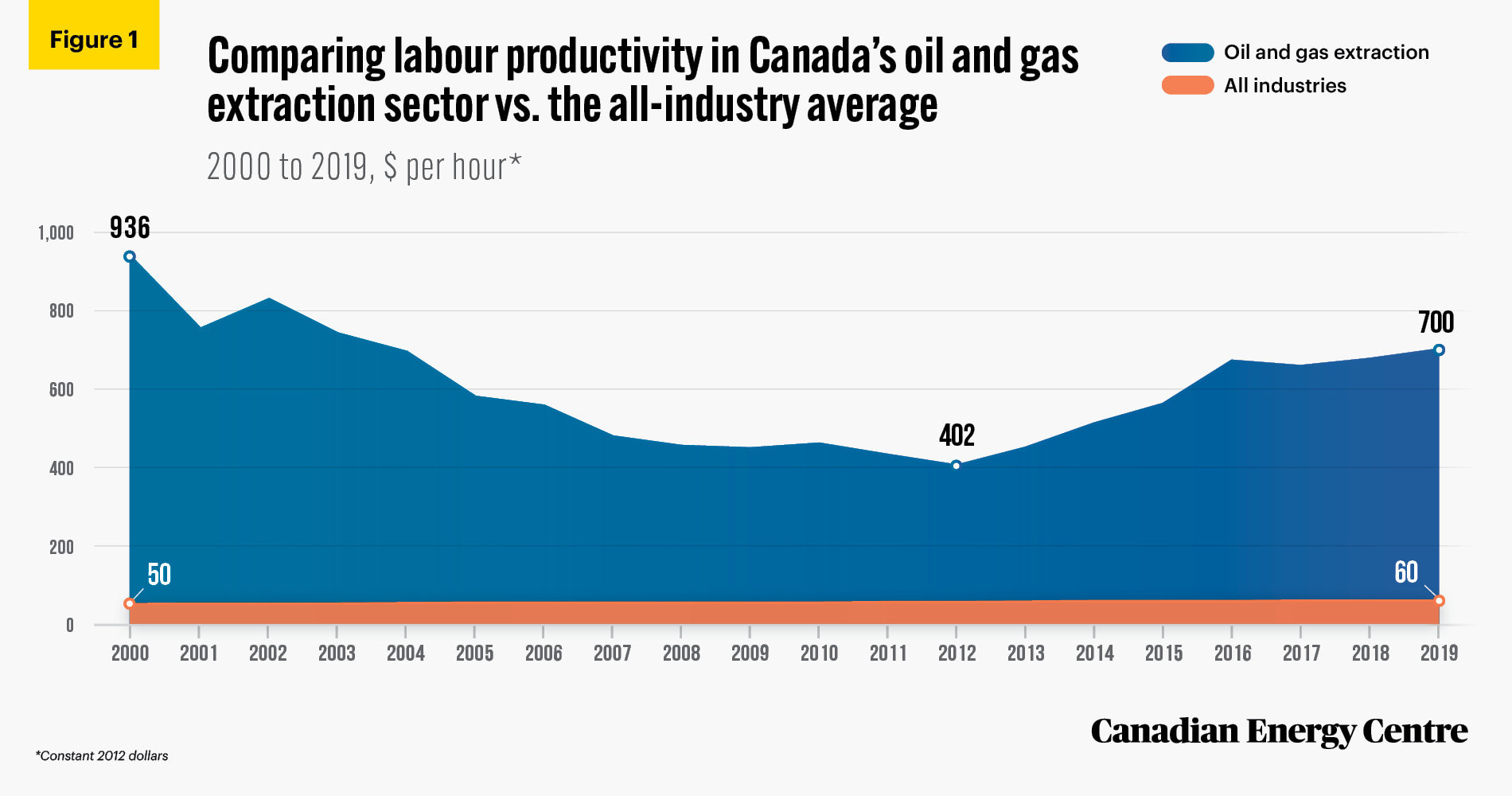

Despite energy price gyrations, the oil and gas extraction sector has been an important contributor to Canada’s labour productivity over the past two decades.

Thus, in this CEC Fact Sheet, we examine trends in labour force productivity in the Canadian oil and gas extraction sector between 2000 and 2019, compare oil and gas extraction sector productivity performance with other key sectors of the economy, and compare Canada’s mining and utilities and oil and gas extraction labour productivity with that of other energy-producing nations.

Why is labour productivity important?

To understand labour productivity and why it matters, consider the revolution in farming that took place over centuries. Farmers moved from plowing fields using animals, or even their own labour, to tilling their fields with mechanized vehicles such as tractors. That change allowed for a greatly increased yield per hectare, which in turn translated into less physical work but often more income, and much more food to sustain growing populations worldwide.

In short, farmers produced much more food with much less effort. This is an example of the importance of labour productivity.¹ As the Business Council of BC describes it, “a country’s standard of living ultimately depends on its labour productivity, that is, its ability to generate the highest possible level of income or output, per unit of labour input…”

1. In more technical language, productivity measures the efficiency with which an economy transforms inputs, such as labour and capital inputs, into outputs. Statistics Canada points out that “productivity growth is closely related to growth in Canada’s standard of living. Output growth must come either from growth in inputs and/or from growth in productivity. Indeed, this is the principle that underlies the basic method of estimating productivity growth. Productivity growth occurs when the growth in outputs is in excess of inputs, such as labour” (Statistics Canada, 2018).

Source: Statistics Canada, Table 36-10-0480-01. *Constant 2012 dollars

Labour productivity always high in Canada’s oil and gas sector

Historically, labour productivity performance in Canada’s oil and gas extraction sector has been high and has contributed significantly to the country’s elevated standard of living. This is because the sector is a capital-intensive and value-added industry, which means that it uses relatively more capital than labour in its production processes. The high income levels that Canada’s oil and gas extraction sector generate also create demand for other goods and services throughout the rest of the economy.

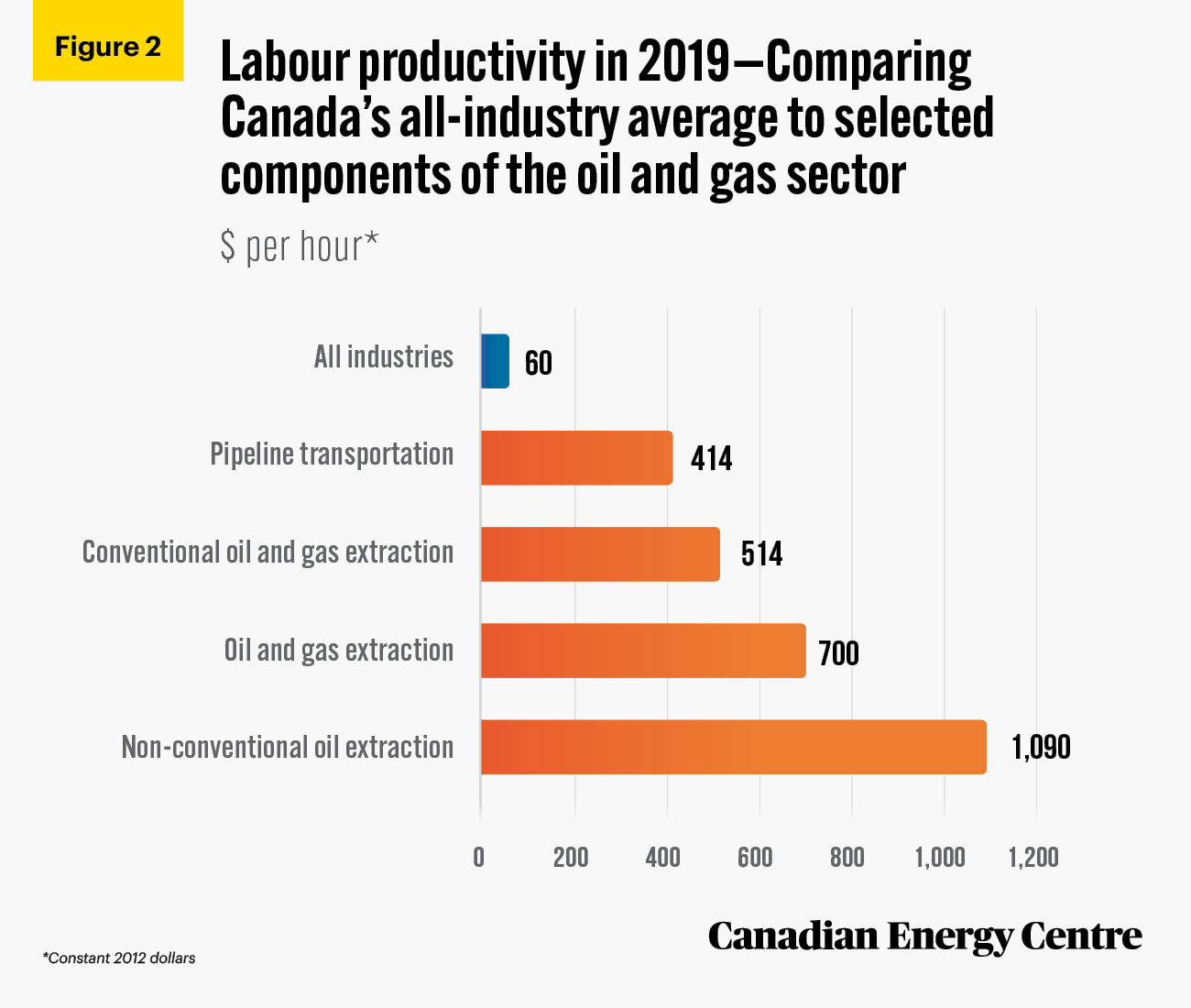

Every hour worked in Canada’s oil and gas extraction sector in 2019 generated nearly $700 ($699.70) in real income.² Of note, the non-conventional oil extraction subsector has driven the high level of labour productivity in the sector overall, generating real income of $1,090.00 for every hour worked in 2019 (see Figures 1 and 2).

To illustrate the importance of oil and gas extraction to the country’s labour productivity, in 2019 Canada’s overall industry labour productivity rate was $60.00 in real income for every hour worked. Thus, the labour productivity rate of Canada’s oil and gas extraction sector ($699.70) was nearly 12 times higher than the industry sector average ($60.00) that year.

2. Expressed in 2012 dollars.

Source: Statistics Canada, Table 36-10-0480-01.

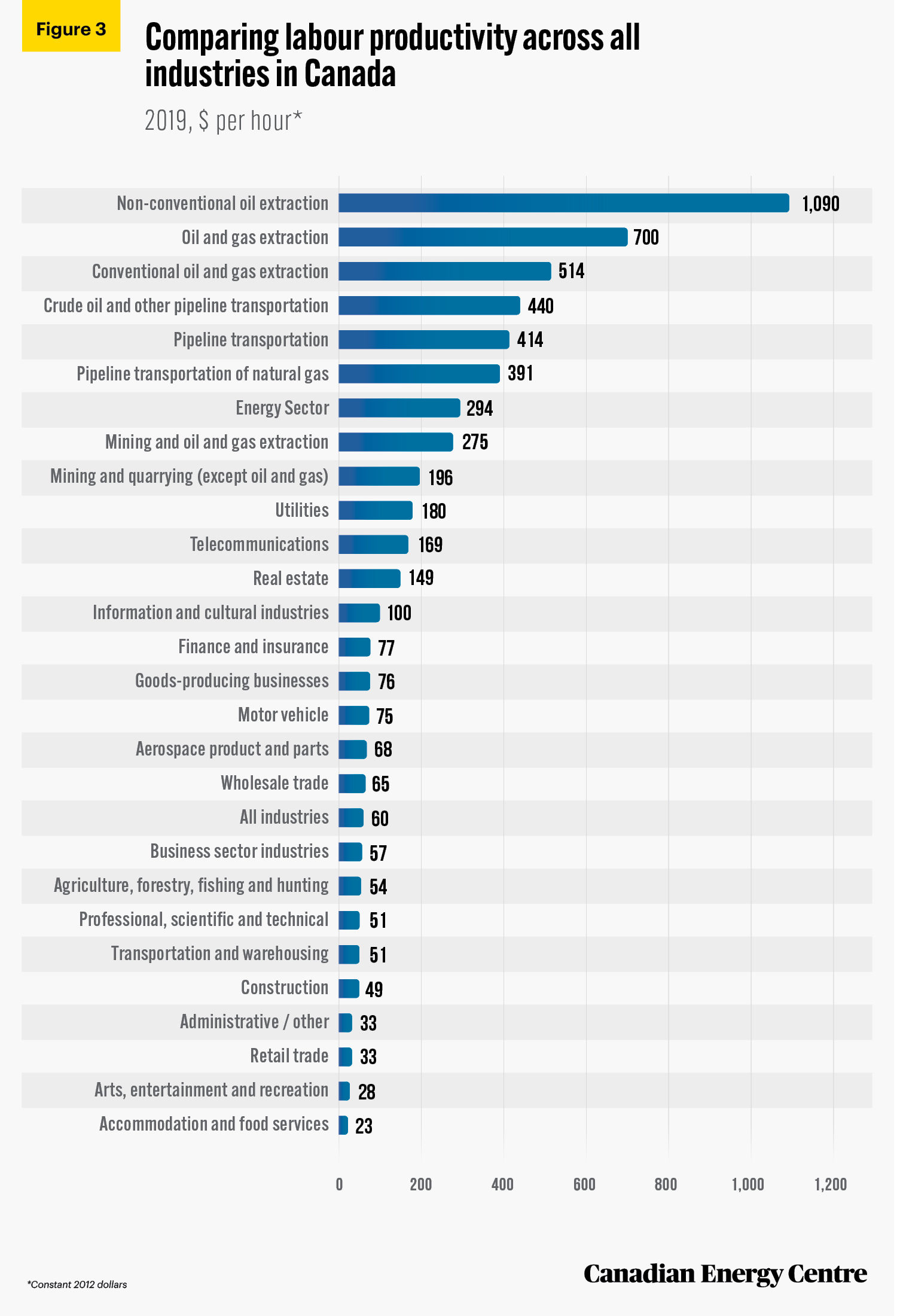

Labour productivity in Canada’s oil and gas sector compared with other key sectors of the economy

At nearly $700 per hour, labour productivity in Canada’s oil and gas extraction sector compares very favourably to other key sectors of the country’s economy (see Figure 3).

- Oil and gas extraction labour productivity is well ahead—in multiples measured in “dozens”— of non-resource sectors, including those in the service sector such as accommodation and food services, and arts, entertainment, and recreation.

- The oil and gas extraction sector is also multiples ahead of the other manufacturing sectors such as aerospace product and parts manufacturing, motor vehicle manufacturing, and all manufacturing as a group.

- Labour productivity in the oil and gas extraction sector is also significantly ahead of that for construction; wholesale trade; warehousing; professional, scientific and technical services; agriculture, forestry, fishing and hunting; utilities; real estate; finance and insurance; and transportation and telecommunications.

According to the Business Council of BC, “the oil and gas sector’s openness to international competition and trade engenders its intensive use of capital, skills, advanced technologies and economies of scale which are all critical to productivity gains.”

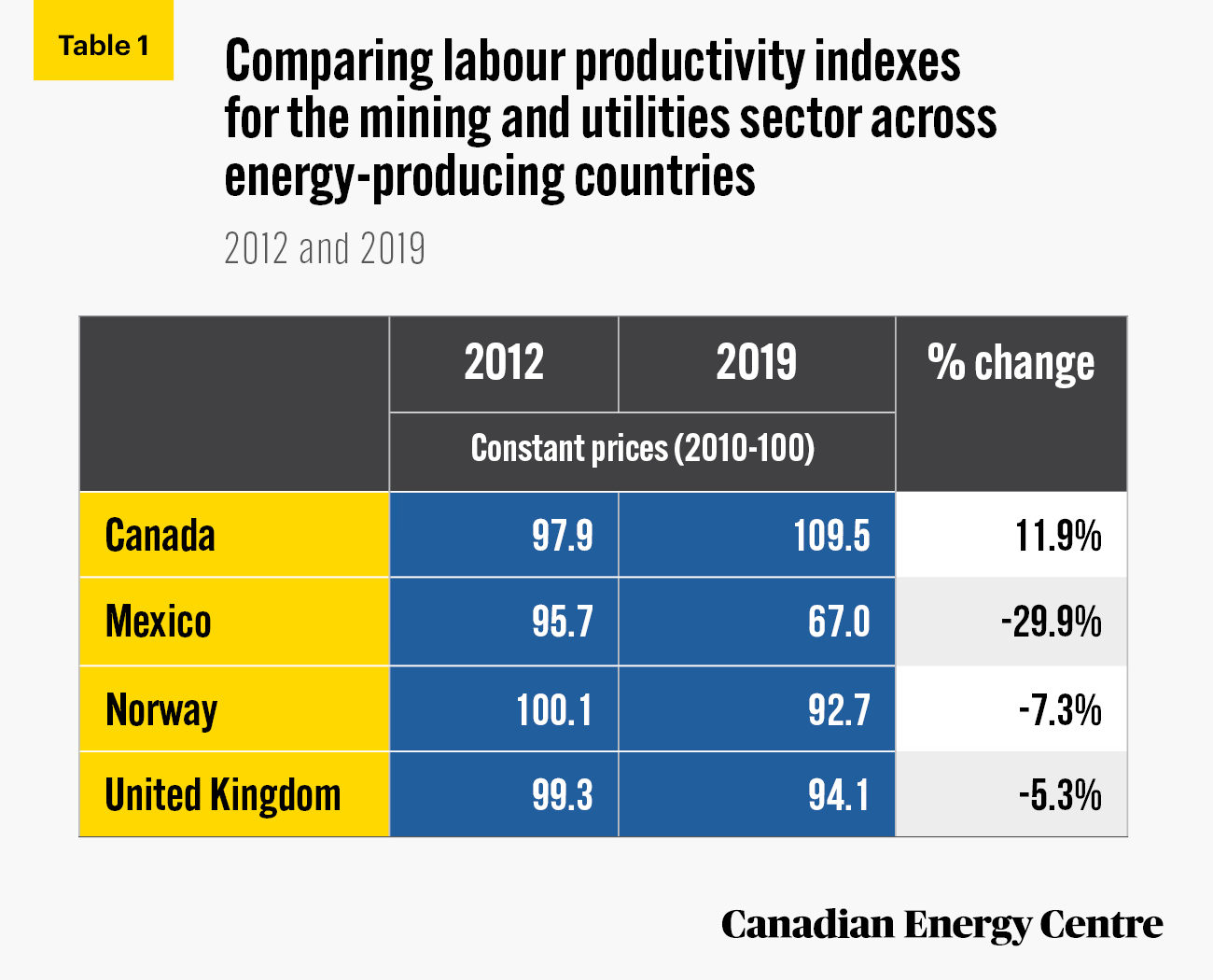

Canadian mining and utilities sector labour productivity compares favourably with other energy-producing countries, but Canadian oil and gas extraction sector trails the US

To compare labour productivity internationally for the mining and utilities sector, we use the Labour Productivity Index (LPI).³ The LPI can be used to identify trends in labour productivity within the mining and utilities sector, and to compare Canada with other energy-producing countries.⁴ (This comparison is distinct from the other measurements because it computes prices based on the base year.) We refer to “mining and utilities” here because this category includes the extraction of minerals occurring naturally as solids (coal and ores), liquids (petroleum), or gases (natural gas). The category includes the production of crude petroleum, the mining and extraction of oil from oil shale and oil sands, and the production of natural gas and the recovery of hydrocarbon liquids.⁵

In 2019, the LPI for the Canadian mining and utilities sector was 109.5 in 2010 constant prices. This compares to favourably Mexico (67.0), Norway (92.7) and the United Kingdom (94.1), (see Table 1).

3. The index is compiled by dividing the real output (GDP) index by the labour input (hours worked) index and shows how efficiently labour input is used for generating real output. 4. GDP in national currency is converted to a common currency, in this case, US dollars. The sectoral breakdown for international comparison follows the United Nations, International Standard Industry Classification of all Economic Activities (ISIC), Rev.4. 5. The category excludes support activities for petroleum and gas extraction, such as oil and gas field services, performed on a fee or contract basis, oil and gas well exploration, and test drilling and boring activities. This division also excludes the refining of petroleum products and geophysical, geologic, and seismic surveying activities (United Nations, 2008).

Source: Knoema, 2020.

US-Canada comparisons

Using a different data set that allows for a closer US-Canada comparison, we find that the pace of labour productivity growth in the oil and gas extraction sector over the past decade has been much greater in the United States than in Canada. Between 2012 and 2019,

- On the LPI, the Canadian oil and gas extraction sector overall rose from 100.1 to 126.8 in 2010 constant prices, an increase of nearly 27 per cent.

- Meanwhile, the US Bureau of Labour Statistics reports that for the same years, the LPI in the US oil and gas extraction sector rose from 85.5 to 204.3 in 2007 constant prices, an increase of 139 per cent.

According to the Federal Reserve Bank of Kansas, “the surge in the United States has been driven in part by a focus on more core areas of plays in recent years, which naturally are more productive. There have been also been a number of key drilling and technology enhancements, including longer horizontal laterals, multi-well pad drilling, walking rig systems and increased proppant concentrations in hydraulic fracturing which have increased labour productivity.”

In fact, the US oil and gas extraction industry has experienced historic labour productivity growth since 2012.

Also, again according to the Federal Reserve Bank of Kansas, “the outlook in the next decade for U.S. oil and gas production could be quite positive, but the outlooks for oil and gas investment and employment are more uncertain. Oil and gas is a commodity industry, and thus generally more susceptible to wide positive and negative swings in prices and activity. Somewhat related, it is also an industry with a sizable cartel, OPEC, which can affect production levels of producing countries across the world. As such, future production trends could be considerably higher—or lower— than in past high-productivity industries.”

Source: Statistics Canada, Table 36-10-0480-01.

Conclusion

Canada’s oil and gas extraction sector continues to provide significant value-added to the economy as evidenced by its high rate of labour productivity in relation to the all-industry average and other key industry sectors over the past two decades.

Productivity gains are critical to the Canadian economy as the working population ages and revenue growth slows. As governments turn their attention towards long-term economic recovery from COVID-19, it will be important to create favourable conditions for improving productivity and competitiveness in the oil and gas extraction sector. This includes efforts to improve the regulatory regime to remove impediments to industry performance.

In this respect, the Canadian oil and gas extraction sector is well-positioned. It already provides significant value-added to the Canadian economy in labour income, revenues, export earnings, and spending on research and development (R&D) with an environmental focus.

Notes

This CEC Fact Sheet was compiled by Lennie Kaplan and Mark Milke at the Canadian Energy Centre (www.canadianenergycentre.ca). The authors and the Canadian Energy Centre would like to thank and acknowledge the assistance of an anonymous reviewer in reviewing the data and research for this Fact Sheet. Image credits: ‘Construction worker’ by Burst from Pexels.com

References (All links live as of February 15, 2021)

Business Council of BC (2020), Which Industries Pay Canada’s Bills (2020) <https://bit.ly/3qMRia2>; Centre for the Study of Living Standards (2014), The Impact of the Oil Boom on Canada’s Labour Productivity Performance, 2000-2012 <https://bit.ly/2Wj0a9v>; Federal Reserve Bank of Kansas (2018), Oil and Gas Productivity Doubled in the Past Five Years- What Happens Next? <https://bit.ly/3mbSlfY>; Government of Alberta (2016), Trends in Labour Productivity in Alberta <https://bit.ly/37UCMV1>; Industry Canada (2020), Productivity: Canadian Industry Statistics <https://bit.ly/2W5iGSt>; Knoema (2020), Productivity and ULC by main economic activity (ISIC Rev.4) <https://bit.ly/3d1LYv8>; Library of Parliament (2014), Productivity in Canada, Concepts and Issues <https://bit.ly/3oVwmMr>; OECD (2019), OECD Compendium of Productivity Indicators <https://bit.ly/2IFxZhH>; Statistics Canada (2014), Productivity: What Is It? How Is It Measured? What Has Canada’s Performance Been over the Period 1961 to 2012? <https://bit.ly/3mc7u0Z>; Statistics Canada (2018), Research Blog: Productivity in Canada after 2000 <https://bit.ly/3oK5tuI>; Statistics Canada, Table 36-10 0480-01: Labour productivity and related measures by business sector industry and by non-commercial activity consistent with the industry accounts. <https://bit.ly/2NfZLTW>; United Nations (2008), International Standard Industrial Classification of All Economic Activities, Revision 4 <https://bit.ly/2W45tsW>; US Bureau of Labor Statistics (2020), Industry Productivity and Costs <https://bit.ly/3gBvMQZ>.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms with attribution to the CEC. Attribution and specific restrictions on usage including non-commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial-NoDerivs CC BY-NC-ND.