To sign up to receive the latest Canadian Energy Centre research to your inbox email: research@canadianenergycentre.ca

Download the PDF here

Download the charts here

Overview

The impact of the broad oil and gas sector on the GDP and jobs of other key sectors of the Canadian economy is not well known, yet extremely relevant to current discussions about the sector’s importance to Canada’s economic future.

In this Fact Sheet, we examine the indirect impact that the broad oil and gas sector had on the Canadian economy in 2019. We chose the year 2019 due to the availability of Statistics Canada Supply and Use Table (SUT) data. The 2019 SUTs (the latest year available) provide a detailed accounting of the Canadian economy and give information by industry, products, provinces, sectors, and components of final use.

The indirect impact is measured as the GDP and jobs occurring throughout the supply chain of the oil and natural gas industry, attributable to its extraction and investment expenditures. These economic impacts represent the backward linkages of the oil and natural gas industry to its various suppliers. Indirect impacts occur through the oil and gas industry’s purchases of intermediate and capital goods from a variety of other key Canadian industries.

Canada’s oil and gas sector indirect impacts on key industries within the Canadian economy

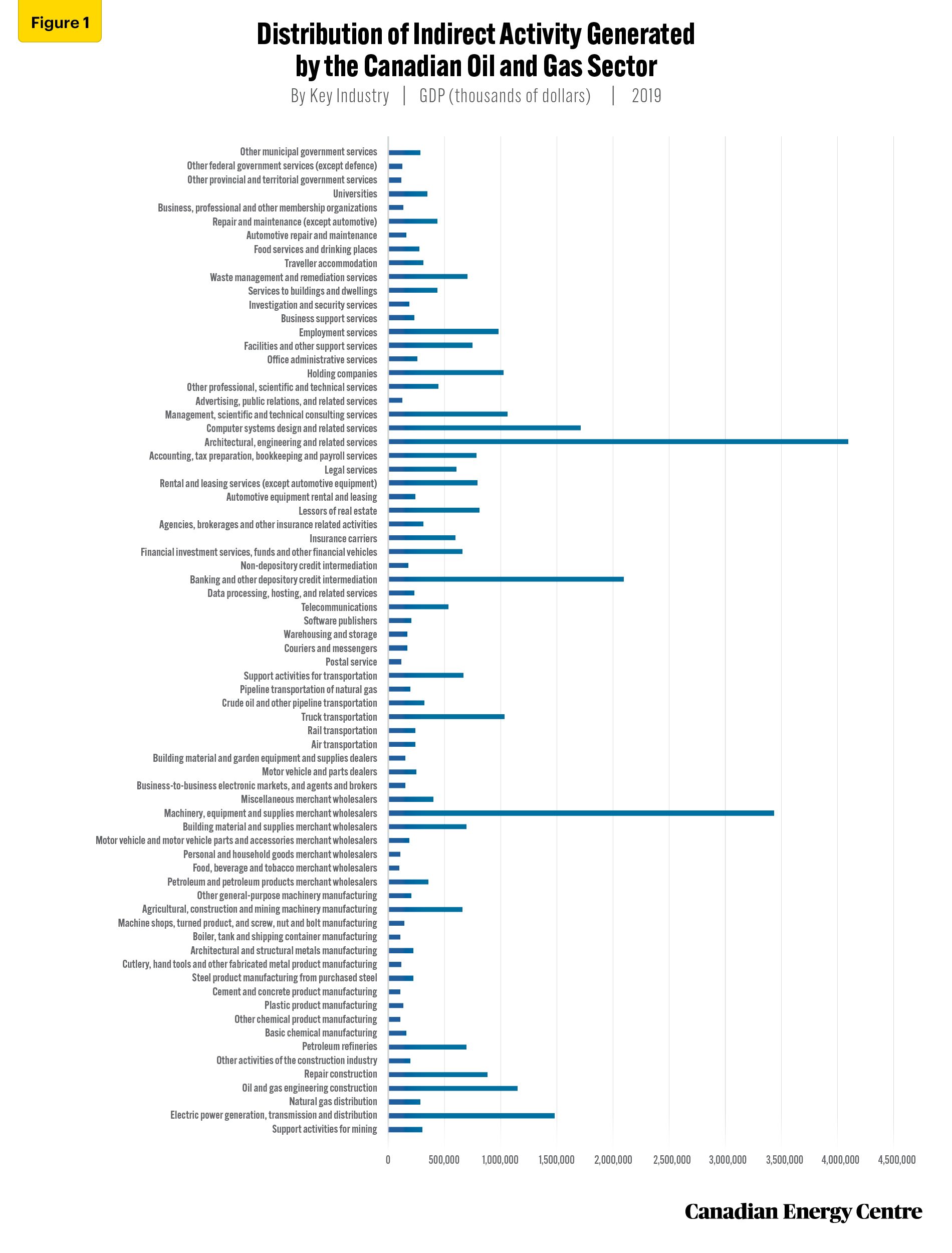

GDP

In 2019, the activities of the Canadian oil and gas sector were indirectly responsible for significant portions of GDP in key industries across Canada. They range from $100.9 million in GDP in in the industry categorized as food, beverage, and tobacco merchant wholesalers to nearly $4.1 billion in GDP for architectural, engineering, and related services (see Figure 1).

Source: Derived from Statistics Canada Custom Tabulation of the Supply and Use Tables, 2019

For GDP, the top five industries associated with the activities of Canada’s oil and gas sector, in 2019, included:

- Architectural, engineering, and related services: $4.1 billion

- Machinery, equipment and supplies merchant wholesalers: $3.4 billion

- Banking and other depository credit intermediation: $2.1 billion

- Computer systems design and related services: $1.7 billion

- Electrical power generation, transmission, and distribution: $1.5 billion (see Figure 2).

Source: Derived from Statistics Canada Custom Tabulation of the Supply and Use Tables, 2019

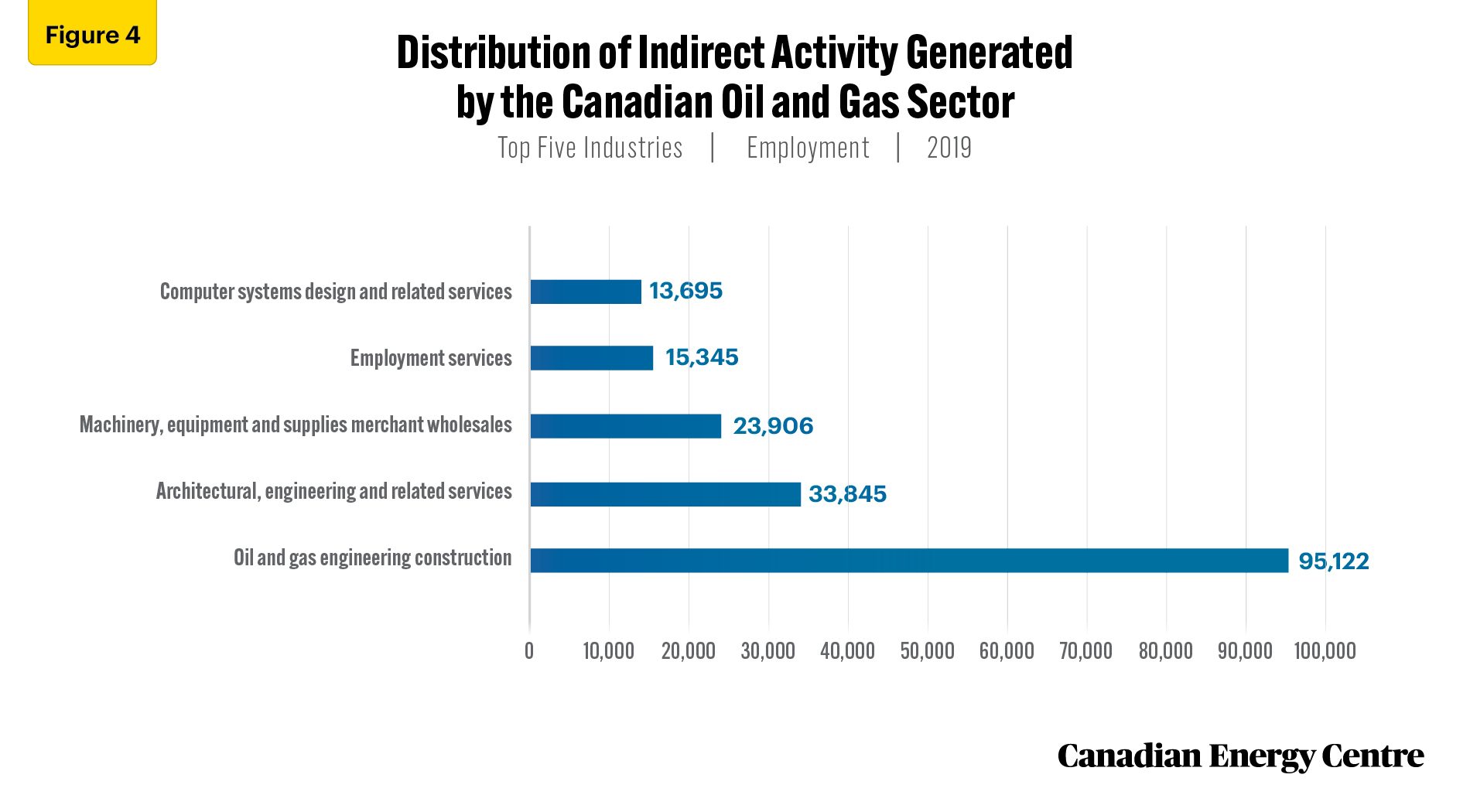

Jobs

In 2019, the Canadian oil and gas sector was indirectly responsible for jobs created in other key industries, ranging from 1,033 jobs in the taxi and limousine service industry to 95,122 jobs in oil and gas engineering construction (see Figure 3).

Source: Derived from Statistics Canada, Custom Tabulation of the Supply and Use Tables, 2017

For jobs, the top five industries associated with the activities of Canada’s oil and gas sector, in 2019, included:

- Oil and gas engineering construction: 95,122

- Architectural, engineering, and related services: 33,845

- Machinery, equipment and supplies merchant wholesalers: 23,906

- Employment services: 15,534

- Computer systems design and related services: 13,695 (see Figure 4).

Source: Derived from Statistics Canada, Custom Tabulation of the Supply and Use Tables, 2017

Notes

This CEC Fact Sheet was compiled by Lennie Kaplan at the Canadian Energy Centre (www.canadianenergycentre.ca). The authors and the Canadian Energy Centre would like to thank and acknowledge the assistance of Philip Cross and two anonymous reviewers in reviewing the original data and research for this Fact Sheet.

Methodology

The estimates presented in this paper are the result of a Statistics Canada custom tabulation of the Canadian oil and gas sector taken from the Supply and Use Tables (SUTs). The SUTs capture and present the production of products by domestic industries, imports of products as well as their use, either as inputs, final consumption, investment, or exports. The latest SUTs are for the 2019 calendar year. The total (direct and indirect) impact of the oil and gas industry on the Canadian economy can be quantified using input-output multipliers derived from the SUTs. According to Statistics Canada (2018), these multipliers “provide a measure of the interdependence between an industry and the rest of the economy” (Statistics Canada, 2018, National and Provincial Multipliers, Surveys and statistical programs, Documentation: 15F0046X). As Statistics Canada notes, although there is a lag from the 2017 data, the structure of the Canadian economy evolves slowly, so the lag should have a minimal impact on the estimates of GDP, jobs, and output (Statistics Canada, Economic Insights, 11-626-X, No. 109, The Decline in Production and Investment in Canada’s Oil and Gas Sector and its Impact on the Economy, July 2020. This fact sheet applies the same concepts and definitions of oil and gas extraction activities as used by the North American Industry Classification System (NAICS), Canada 2012. The Canadian SUTs use the Supply and Use Product Classification (SUPC) system, a variant based on the North American Product Classification System (NAPCS), to classify products within the economy.

Definitions

Using Statistics Canada terminology, we define the broad Canadian oil and gas sector as the sum of oil and gas extraction (NAICS 211) and oil and gas investment. For the purposes of NAICS and NAPCS, oil and gas extraction comprise establishments primarily engaged in operating oil and gas field properties. Such activities may include exploration for crude petroleum and natural gas; drilling, completing, and equipping wells; operating separators, emulsion breakers, desilting equipment, and field gathering lines for crude petroleum; and all other activities in the preparation of oil and gas up to the point of shipment from the producing property. This subsector includes the production of oil, the mining and extraction of oil from oil shale and oil sands, and the production of gas and hydrocarbon liquids, through gasification, liquefaction, and pyrolysis of coal at the mine site. Oil and gas investment includes capital expenditures on construction, machinery and equipment, and exploration by the oil and gas extraction industry. GDP is defined as the unduplicated value of the goods and services produced in the economy. Output consists primarily of the value of goods and services produced by an industry. Jobs include employee jobs (full-time, part-time, and seasonal) and self employed jobs. The direct impact of oil and gas extraction is the effects directly attributed to this industry’s production. The direct impact of oil and gas investment is the deliveries by domestic industries to satisfy capital expenditures by the oil and gas extraction industry. The indirect impact covers upstream economic activities associated with supplying intermediate inputs (the current expenditures on goods and services used up in the production process) to the directly affected industries. (Excerpts taken from Statistics Canada, Contribution of the Oil and Gas Sector to the Canadian Economy in 2016, 2020, custom tabulation.)

References (All links live as of August 22, 2023)

Statistics Canada (2020), The Decline in Production and Investment in Canada’s Oil and Gas Sector and its Impact on the Economy, July 2020, Economic Insights, 11-626-X, No. 109 <https://bit.ly/32LbTlb>; Statistics Canada (2023a), Custom tabulation of the oil and gas sector derived from the 2019 Supply and Use Tables; Statistics Canada (2023b), Table 36-10-0478-01: Supply and use tables, 2019, detail level, provincial and territorial (x 1,000), <https://bit.ly/3mCm9nt>; Statistics Canada (2023c), Supply, Use and Input-Output Tables, 2021 <https://bit.ly/2G0S3tk>.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms with attribution to the CEC. Attribution and specific restrictions on usage including non-commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial-NoDerivs CC BY-NC-ND.