Momentum is building for the long-awaited start-up of Canada’s first liquefied natural gas (LNG) export project.

Shipments from the LNG Canada terminal at Kitimat, B.C. may now start earlier than expected, later this year rather than mid-2025, according to Martin King, Canadian energy specialist with Houston-based RBN Energy.

“LNG Canada appears to be on the cusp of its testing phase and is likely to be exporting some cargoes of LNG before the end of this year,” King wrote recently.

He made the prediction after a senior executive with Shell, the project’s lead owner, said it could deliver its first cargo earlier than previously planned, in the wake of two key milestones.

Fluor reported in July it had completed the final weld on the first production train while Petronas, which holds a 25 per cent stake in LNG Canada, announced it would add three LNG vessels to its North American fleet, doubling its size.

A longtime industry insider sees the $18 billion LNG Canada terminal as a game changer.

“This is decades in the making. Canada has been trying to get its LNG business up and running since the 1970s but it has been sidetracked for one reason or another,” says Calgary-based consultant Racim Gribaa, who has worked in the industry for more than 25 years.

“This project is perfectly placed to take advantage of an awesome opportunity given the demand for LNG worldwide is growing exponentially.”

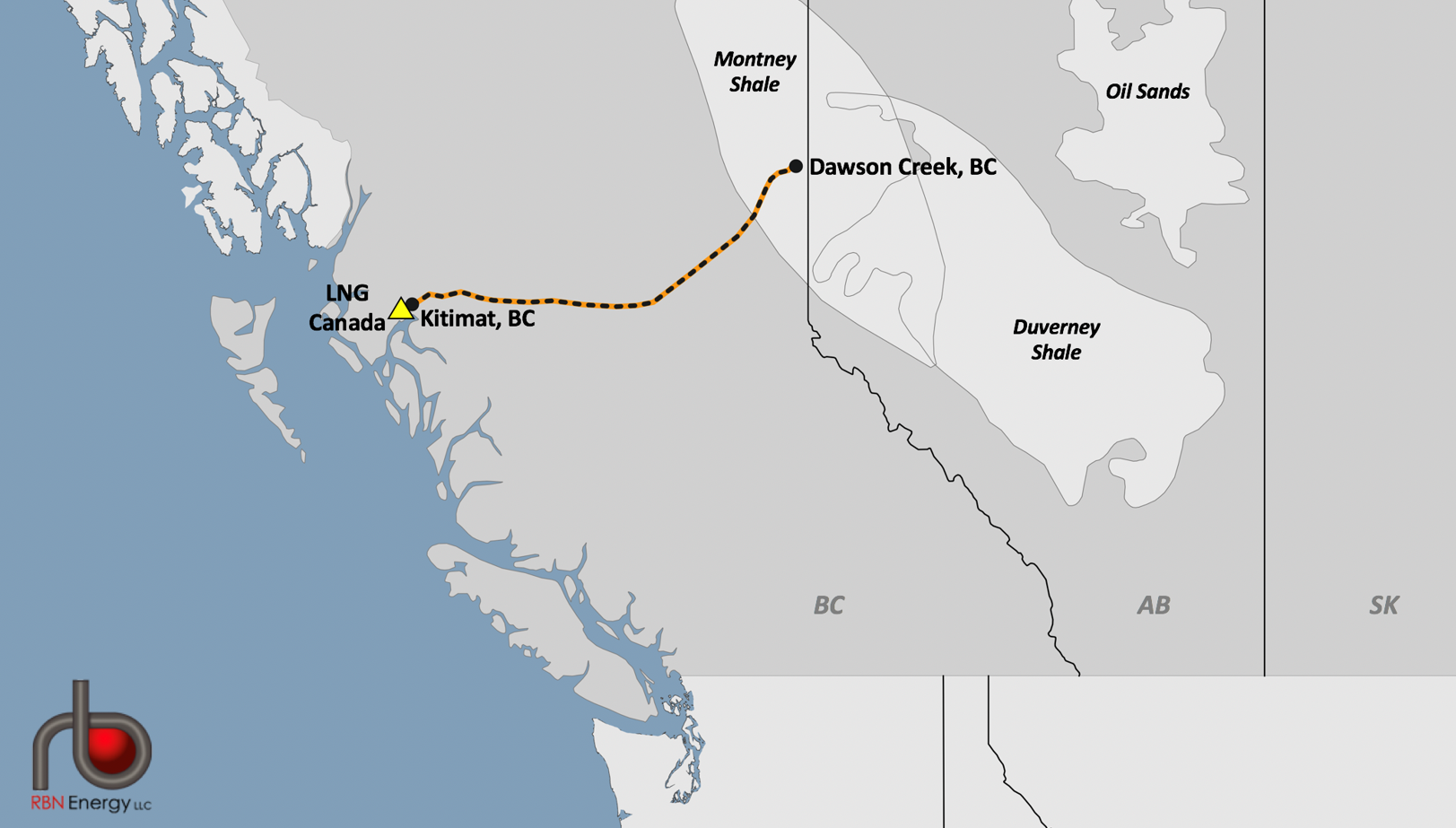

The project, which will use the Coastal GasLink pipeline, completed in November 2023, to bring gas from northeastern British Columbia to the Kitimat terminal for processing and shipping, will have capacity to produce up to 14 million tonnes per year in its first phase.

While that’s a fraction of the 404 million tonnes of global demand in 2023, Gribaa says Asian buyers view LNG Canada as secure supplier in part due to its geography.

“The closest point to Asia is Canada’s west coast, so you have the shortest shipping route, which makes for optimal transportation costs. The traders and LNG industry see it as valuable for that reason,” says Gribaa, who previously worked in LNG trade in Qatar, one of the world’s largest exporters.

And the project is coming online at a time when worldwide demand is surging.

“The worldwide demand has effectively doubled every decade since 1990, when it was 50 MPTA. We are now closing in on 500 MPTA and that is accelerating,” Gribaa says.

“The world will need 10 LNG Canadas in 10 years and 100 more LNG Canadas in the next 30 years.”

The project has plans for a second phase that would double production to 28 million tonnes per year. Based on demand, Gribaa says “the question isn’t if it will go forward, it’s when the consortium will announce the expansion.”

World LNG demand growth will be particularly strong in Asia, where Shell’s four LNG Canada partners – Petronas (25 per cent), PetroChina (15 per cent), Mitsubishi (15 per cent) and Korea Gas Corporation (five per cent) – are headquartered.

“Each of these markets has historical demand for LNG and that demand will continue to grow in the coming decades,” he says, adding that LNG in Asia can be used for power generation and heavy industry, and to reduce air pollution from coal-fired power.

Overall, generating electricity in China with LNG from Canada rather than coal could reduce emissions by up to 62 per cent, according to a 2020 study published in the Journal for Cleaner Production.

A 2022 study by Wood Mackenzie found that growing Canada’s LNG industry could reduce net emissions in Asia by 188 million tonnes per year through 2050.

The unaltered reproduction of this content is free of charge with attribution to the Canadian Energy Centre.