To sign up to receive the latest Canadian Energy Centre research to your inbox email: research@canadianenergycentre.ca

Download the PDF here

Download the charts here

Overview

This Canadian Energy Centre (CEC) Fact Sheet examines projected Canadian oil sands sector government revenues and capital expenditures (capex) over the next decade under a constant price for Brent crude of $80 US per barrel. The upstream government revenues and capex numbers are expressed in nominal US dollars, assuming a 2.5 per cent inflation rate and a 10 per cent discount rate.

The written content in this report was prepared by the CEC and does not represent the views of Rystad Energy.

Background on Rystad Energy UCube

Rystad Energy is an independent energy research company providing data, analytics and consultancy services to clients around the globe.

UCube is Rystad Energy’s global upstream database, including production and economics (costs, revenues, and valuations) for more than 80,000 assets, covering the portfolios of more than 3,500 companies.

The UCube data set is used to study all parts of the global exploration and production (E&P) activity value chain, including operational costs, investment (capex and opex), fiscal terms, and net cash flows for projects and companies, both globally and by country (Rystad Energy, 2023).

In this Fact Sheet, we use a relatively conservative price trajectory for our analysis of oil sands sector government revenues and capex, a trajectory that projects Brent crude at a constant $80 U.S. per barrel Brent between 2023 and 2032.

Projected government revenues from the Canadian oil sands sector to reach nearly U.S. $231 billion over the next decade

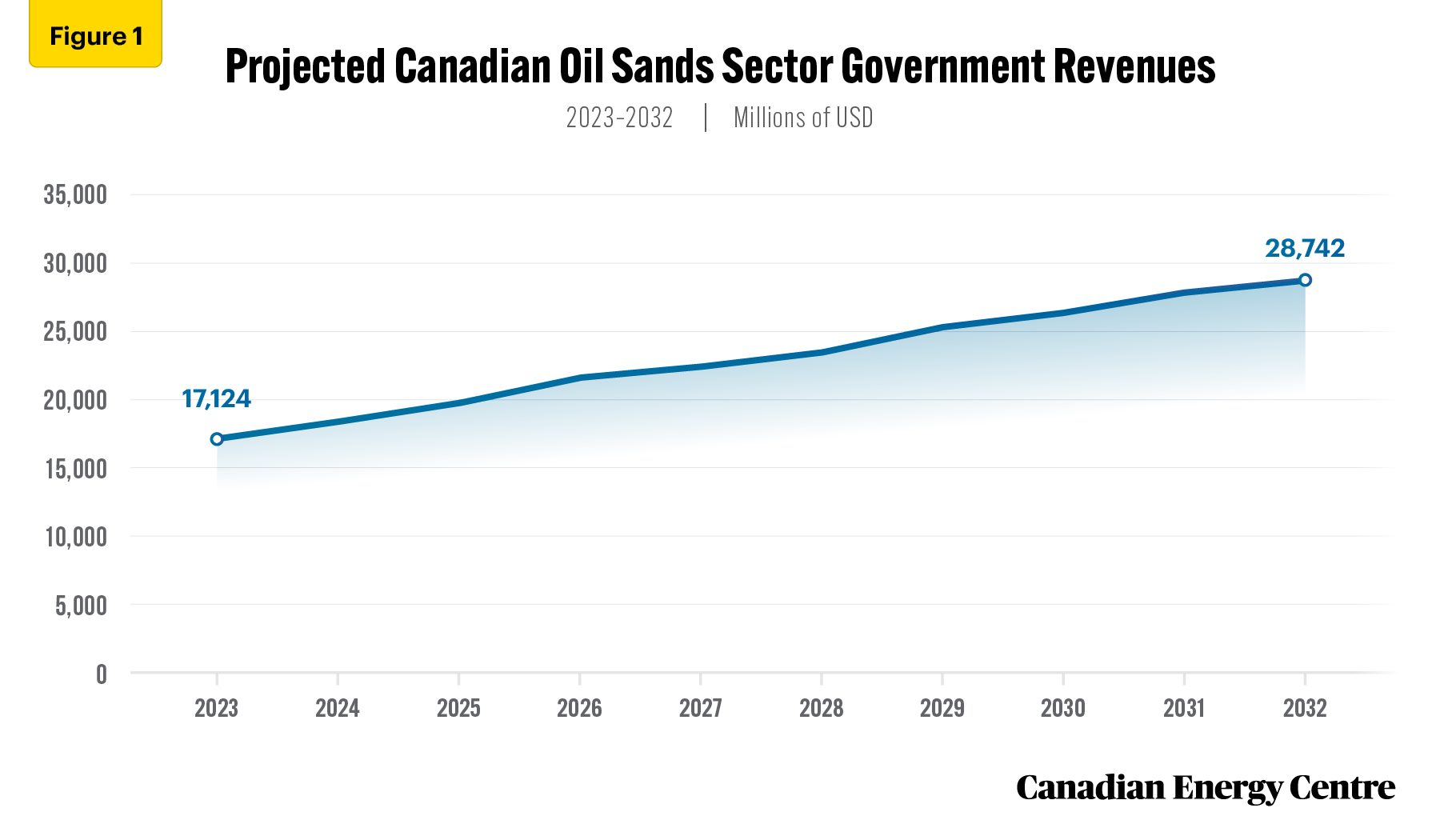

Under the flat US $80 US per barrel price trajectory, government revenues in Canada from the oil sands sector (which includes provincial royalties and federal and provincial corporate taxes) are expected to rise from U.S. $17.1 billion in 2023 to U.S. $28.7 billion in 2032.

Between 2023 and 2032 cumulatively, government revenues from the oil sands sector are projected at nearly US $231 billion under a flat US $80 US per barrel price trajectory (see Figure 1), which would be about 20 per cent more in Canadian dollars at the current exchange rate.

Source: Derived from the Rystad Energy UCube

Projected capex from Canadian oil sands sector to reach nearly U.S. $113 billion over the next decade

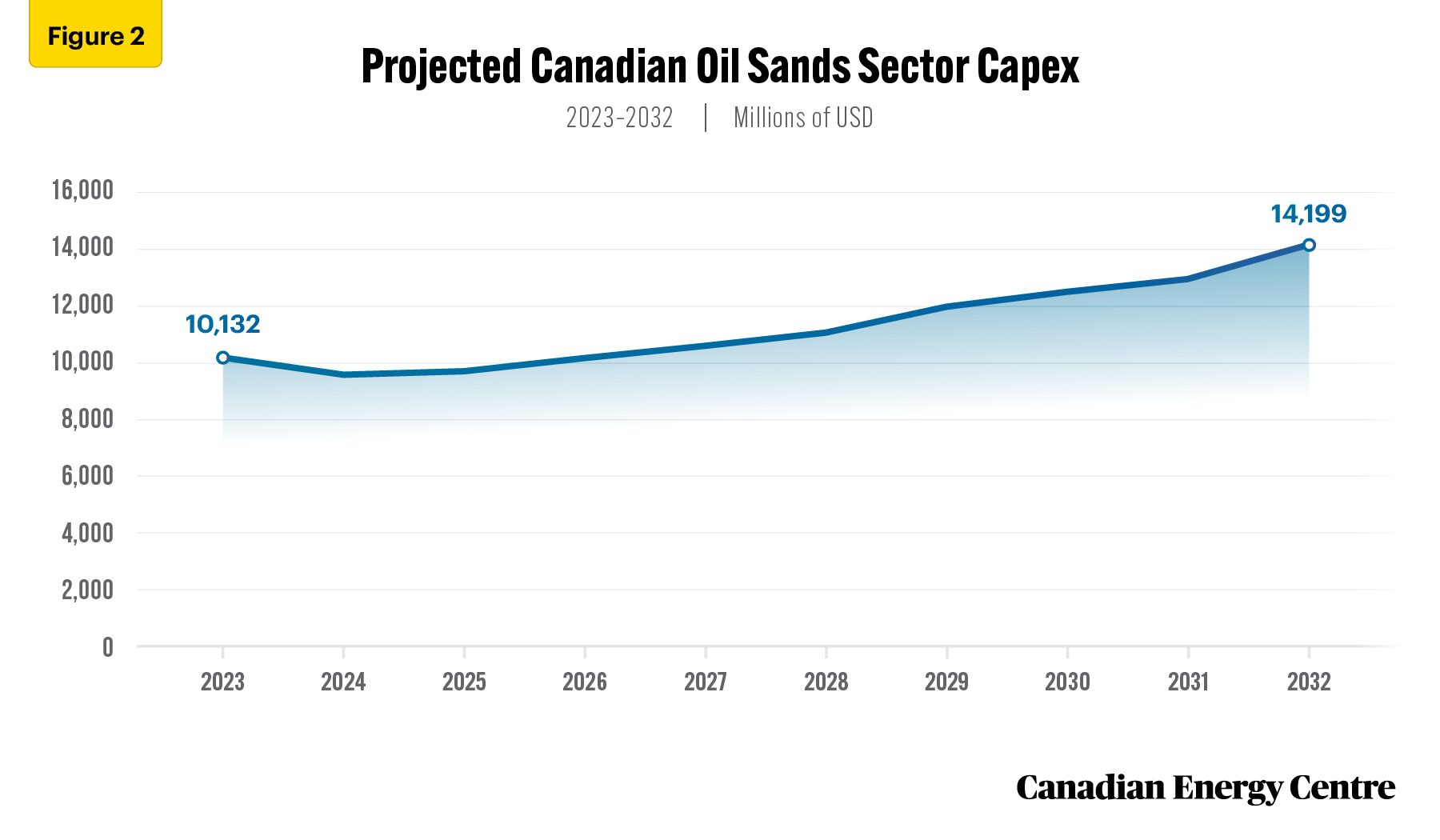

Under a flat U.S. $80 per barrel price trajectory, oil sands sector capex is expected to rise from U.S. $10.1 billion in 2023 to US $14.2 billion in 2032.

Between 2023 and 2032 cumulatively, oil sands sector capex is projected at U.S.$112.7 billion under a flat U.S.$80 per barrel price trajectory (see Figure 2), which would be about 20 per cent more in Canadian dollars at the current exchange rate.

Source: Derived from the Rystad Energy UCube

Conclusion

The projected government revenues and capex numbers over the next decade are another indicator of the health of the Canadian oil sands sector.

These numbers show that the oil sands sector is positioned to play a key role as a safe, secure, reliable and clean supplier of oil to a world that is facing potential energy disruptions arising from geopolitical conflict.

Notes

This CEC Fact Sheet was compiled by Lennie Kaplan at the Canadian Energy Centre (www.canadianenergycentre.ca). The author and the Canadian Energy Centre would like to thank and acknowledge the assistance of two anonymous reviewers in reviewing the data and research for this Fact Sheet.

The written content in this report was prepared by the Canadian Energy Centre (CEC) and does not represent the views of Rystad Energy.

Reference (link live as of January 24, 2022)

Rystad Energy UCube. (2023). <https://bit.ly/3veaMIV>.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms with attribution to the CEC. Attribution and specific restrictions on usage including non-commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial-NoDerivs CC BY-NC-ND.