For the first time in five years, a new major oil sands project has been given the green light.

Vancouver, B.C.-based International Petroleum Corporation (IPC) is going ahead with the C$1.1 billion development, called Blackrod, because of the vast resources and energy security it provides, says CEO Mike Nicholson.

“Our undeveloped resources sit in Canada, which is the largest resource holder behind Saudi Arabia and behind Venezuela, and we’re certainly not welcome in those locations,” Nicholson said during a Feb. 7 investor presentation.

“It’s a very stable fiscal regime [and] a very stable political regime for oil and gas investment, and I think the value of this resource base is materially underestimated.”

IPC has accelerated plans for the first phase of the Blackrod project, Nicholson said.

Over the last year the company has increased planned production capacity by 10,000 barrels per day. The project will now be built to produce 30,000 barrels per day, with first oil expected in late 2026.

Blackrod has regulatory approval to produce 80,000 barrels per day.

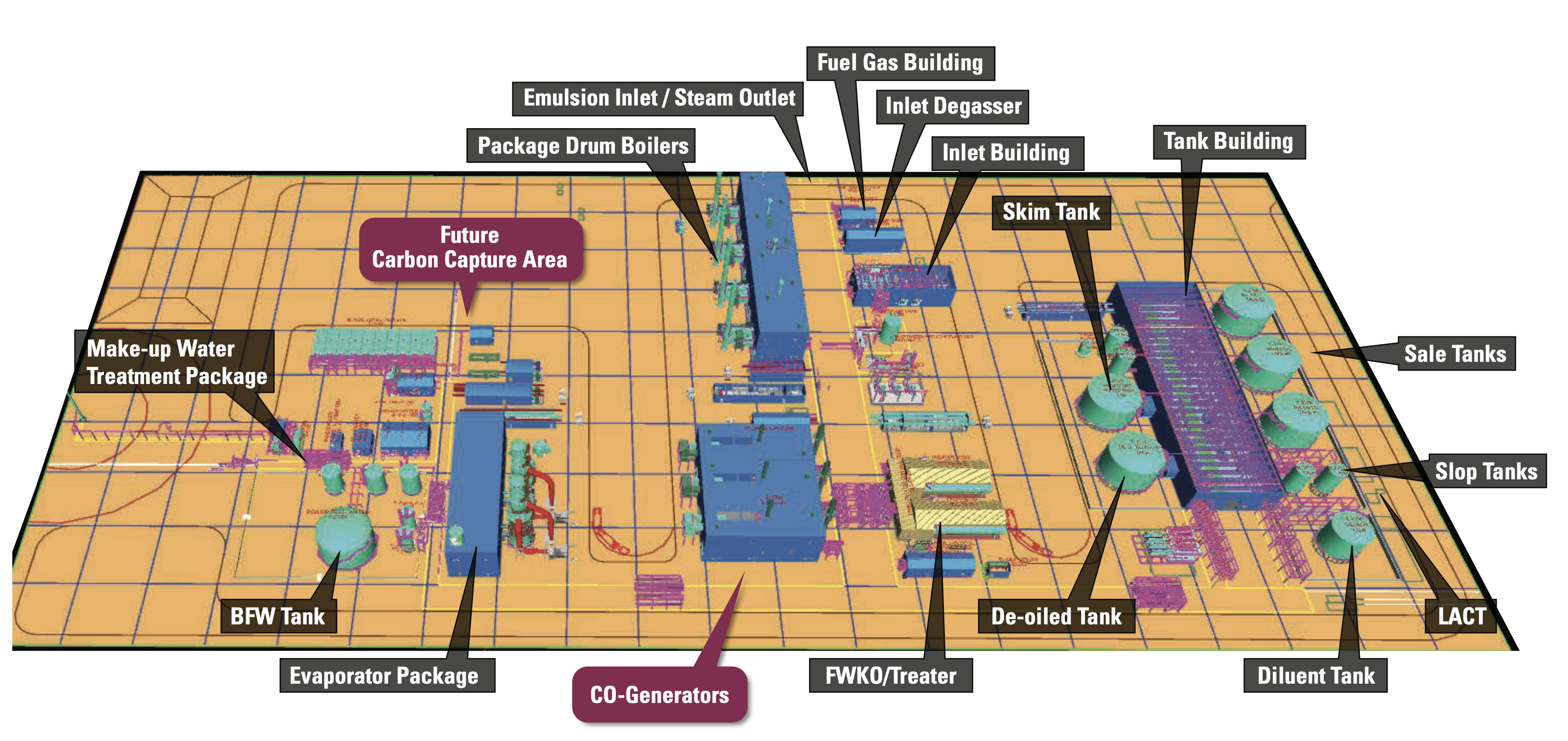

Schematic of the Blackrod Phase 1 central processing facility. Image courtesy International Petroleum Corporation

While IPC may be unique in going ahead with a brand new, so-called “greenfield” oil sands project, the industry’s largest operators are also building for the future.

In Cenovus Energy’s case, long into the future. The company recently filed a regulatory application to extend production at its Christina Lake oil sands project to 2079.

One of the first commercial-scale steam assisted gravity drainage (SAGD) projects, Christina Lake (not to be confused with MEG Energy’s smaller Christina Lake project), is now the industry’s largest “in situ” facility. It produced about 245,000 barrels per day in 2022, or about 16 per cent of the in situ oil sands industry’s total.

Cenovus plans to keep production going for another 50 years by adding well pads in a new area called Kirby West and connecting them to the existing main processing facility.

The extension project is expected to cost about $2.4 billion, and over its decades-long lifespan generate $3.8 billion in royalties and taxes for the governments of Alberta and Canada. First oil is expected in 2031.

As a member of the Pathways Alliance, Cenovus has set the target to reach net zero emissions by 2050, meaning that oil produced beyond that time would incorporate emissions reduction and removal technologies like carbon capture and storage (CCS).

“The oil sands has grown to be a major source of supply globally, and in a system over three million barrels per day, optimizing existing infrastructure can deliver growth, and in some instances with negligible incremental emissions,” says Kevin Birn, who leads S&P Global’s Centre of Emissions Excellence and serves as chief analyst for Canadian oil markets.

Although demand for transportation fuel may eventually weaken, petroleum is also used to make countless products that are expected to rise in demand, from clothing, computers, cell phones, car components and sports equipment to furniture, medical supplies, carpets, toys, and beauty products. Oil – and particularly heavy oil like what is produced in Canada – is also used to make asphalt to make road paving products.

World oil demand is expected to reach a record 101.7 million barrels per day this year, according to the International Energy Agency. Even with increasing adoption of renewable and alternative energy, the IEA projects that global demand will be 102 million barrels per day in 2050.

Eight Capital oil analyst Phil Skolnick says the Kirby West project is “a natural progression” of Cenovus Energy’s Christina Lake project, which started operating in 2002.

“Technology has improved, and they have found ways to be more efficient,” he says.

The unaltered reproduction of this content is free of charge with attribution to Canadian Energy Centre Ltd.