To sign up to receive the latest Canadian Energy Centre research to your inbox email research@canadianenergycentre.ca

Overview

The oil and gas extraction sector in Alberta has made a significant contribution to Canada’s GDP, output and jobs over the past decade. The broader energy sector has also made a significant contribution to federal and provincial government revenues directly in the form of corporate income taxes and royalties (as noted in previous CEC research.)¹

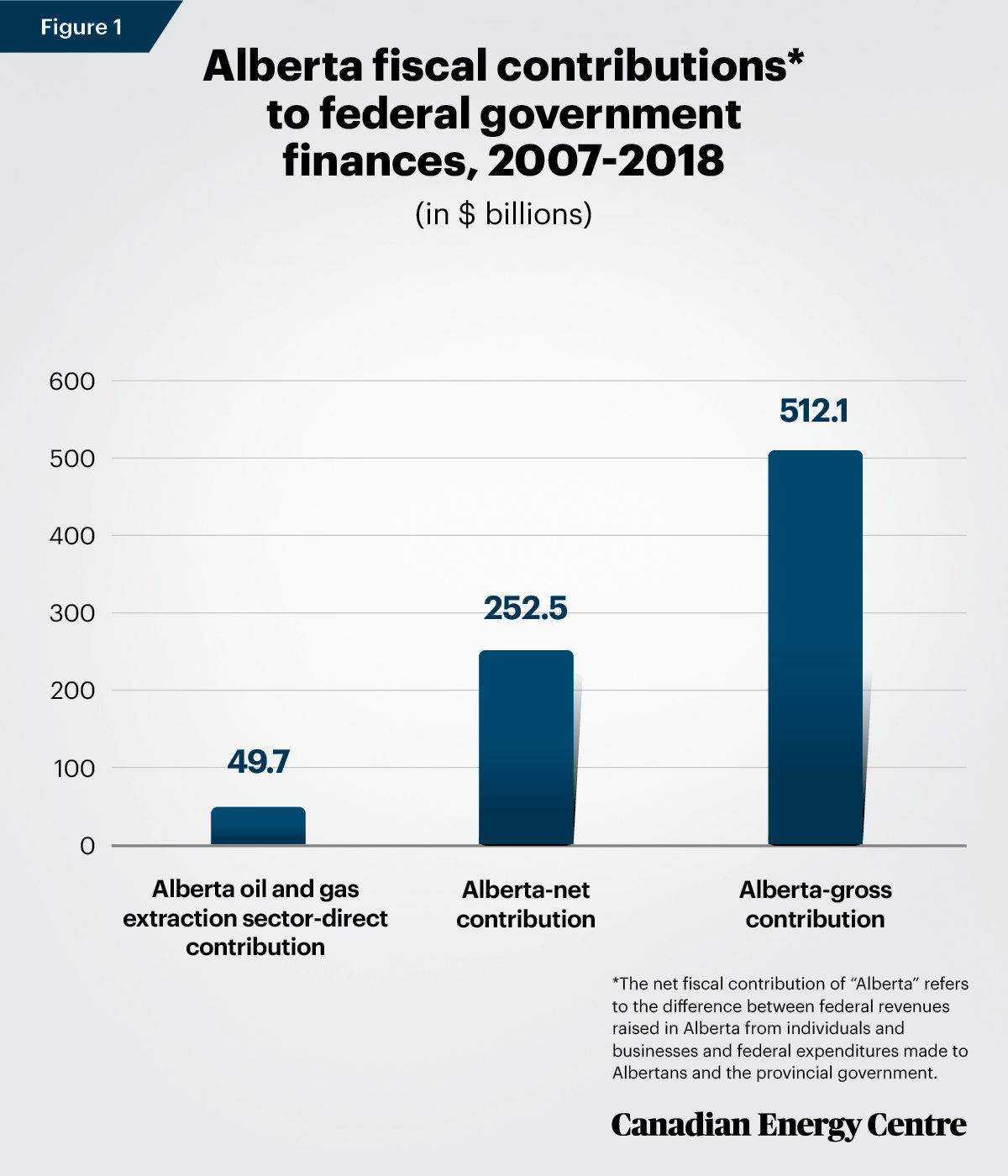

In this Fact Sheet (which can be downloaded here as a pdf), we narrow our focus to the direct impact of the oil and gas extraction sector on Alberta’s gross and net fiscal contribution to federal government finances between 2007 and 2018 (see Figure 1).²

- In the years examined, Alberta’s taxpayers (individual and corporate) made a $512 billion gross contribution and a $252 billion net contribution to federal government finances;

- The direct share from Alberta’s oil and gas extraction sector was, at a minimum, nearly $50 billion, or about 10 per cent of gross Alberta contributions and 20 per cent of Alberta’s total net fiscal contribution over the period;

- On an annual basis, the Alberta oil and gas extraction sector’s annual contribution has ranged from $2.7 billion to $6 billion, or about 15 per cent to just under 32 per cent of Alberta’s total net contribution to the federal government’s finances;

- The average annual oil and gas contribution has been over $4.1 billion per year, over the period; and

- The direct $50 billion figure is understated as it does not include indirect federal taxes on production and taxes on products (i.e. GST, excise taxes, duties, import taxes, air transportation tax, gasoline and motive fuel taxes, etc.) paid by the oil and gas extraction sector in Alberta over the period.

1. See CEC’s March 2020 Fact Sheet #1 where we conservatively estimated energy revenues to federal and provincial and municipal governments at $359 billion between 2000 and 2018. 2. The net annual fiscal contribution of “Alberta” in this fact sheet refers to the difference between federal revenues raised in Alberta from individuals and businesses and federal expenditures made to Albertans and the provincial government. The Alberta government, as with all provincial governments, does not contribute to federal revenues. As with all statistical documents, analysts as well as commentators will often use “shorthand” language, referring to “Alberta’s contributions” to mean tax and others payments from individuals and corporations from those in Alberta to the federal government.

Sources: Derived from Statistics Canada, Table 36-10-0450-01; Table 11-10-0073-01; Table 33-10-0006-01; T1 Family File (custom tabulation); and Financial and taxation statistics for enterprises, by industry type (custom tabulation).

Alberta’s net fiscal contribution to federal government finances: A summary

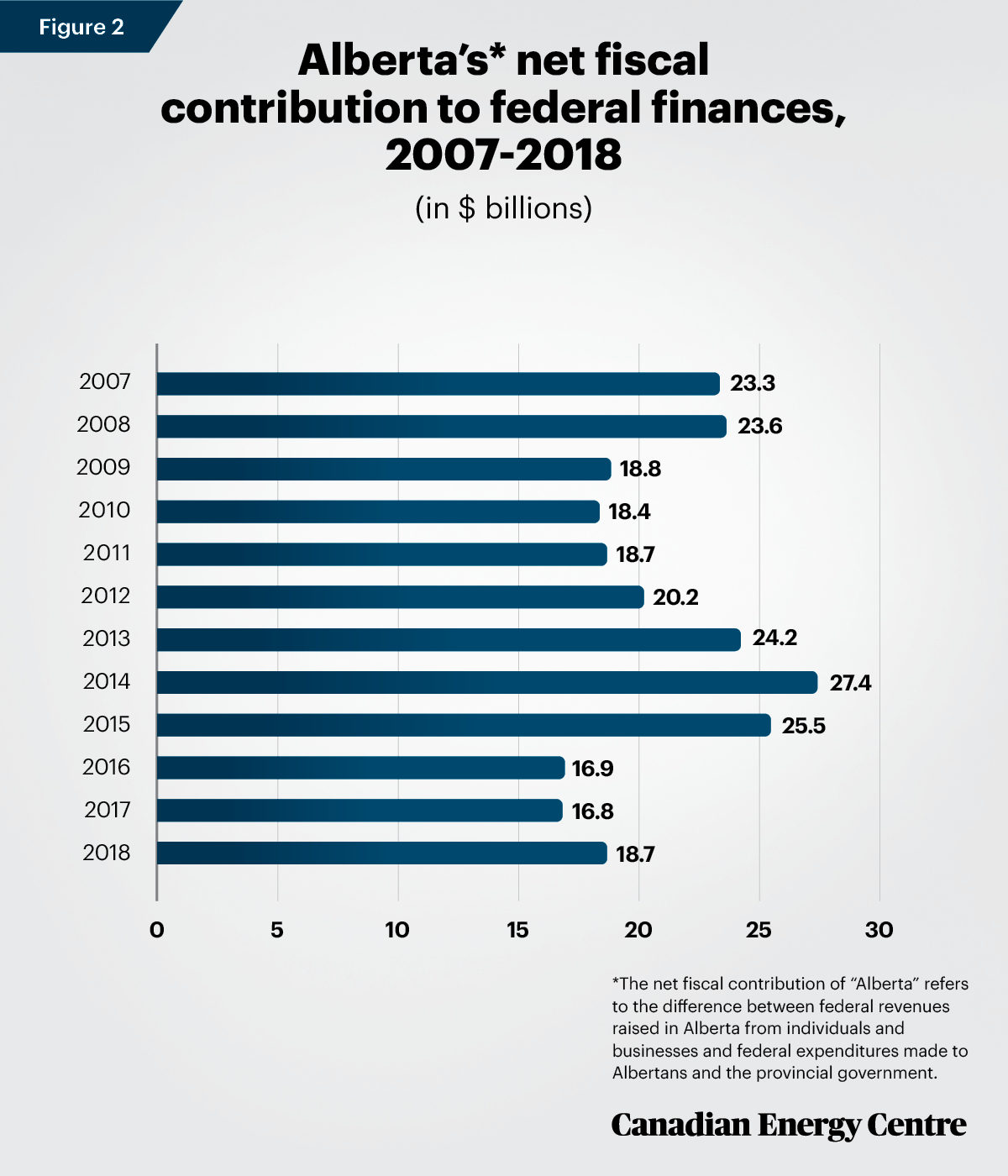

Over the peaks and valleys of energy prices and activity over the period, Alberta’s citizens and businesses have continued to make a significant contribution to federal finances (see Figure 2).

Between 2007 and 2018:

- Alberta’s citizens and businesses made $252.5 billion in net contributions to federal government finances, or an average of $21 billion per year.³

- Alberta’s net contribution to federal finances peaked in 2014 at roughly $27.4 billion. Since then it has declined somewhat, reaching $16.8 billion in 2016 before rebounding to slightly less than $18.7 billion in 2018.

3. Net contributions are calculated by subtracting federal government expenditures in Alberta/to Albertans/to the provincial government from taxes and other revenues paid to the federal government by Albertans and Alberta businesses.

Sources: Derived from Statistics Canada, Table 36-10-0450-01; Table 11-10-0073-01; Table 33-10-0006-01; T1 Family File (custom tabulation); and Financial and taxation statistics for enterprises, by industry type (custom tabulation).

The impact of Alberta’s oil and gas extraction sector on Alberta’s net fiscal contribution to federal government finances

The oil and gas extraction sector’s impact on Alberta’s net fiscal contribution to federal finances is determined by the direct (and indirect⁴) taxes that Alberta individuals and businesses pay to the federal government on an annual basis:

1. Federal personal income taxes, or direct taxes from persons, paid by employees who work directly in Alberta’s oil and gas extraction sector;

2. Federal corporate taxes, or direct taxes from corporations, paid by corporations and business enterprises in the Alberta oil and gas extraction sector;

3. Federal taxes on production and taxes on products (i.e. GST, excise taxes, duties, import taxes, air transportation tax, gasoline and motive fuel taxes, etc.), or indirect taxes paid by the oil and gas extraction sector in Alberta.⁵

Direct federal personal income taxes from persons

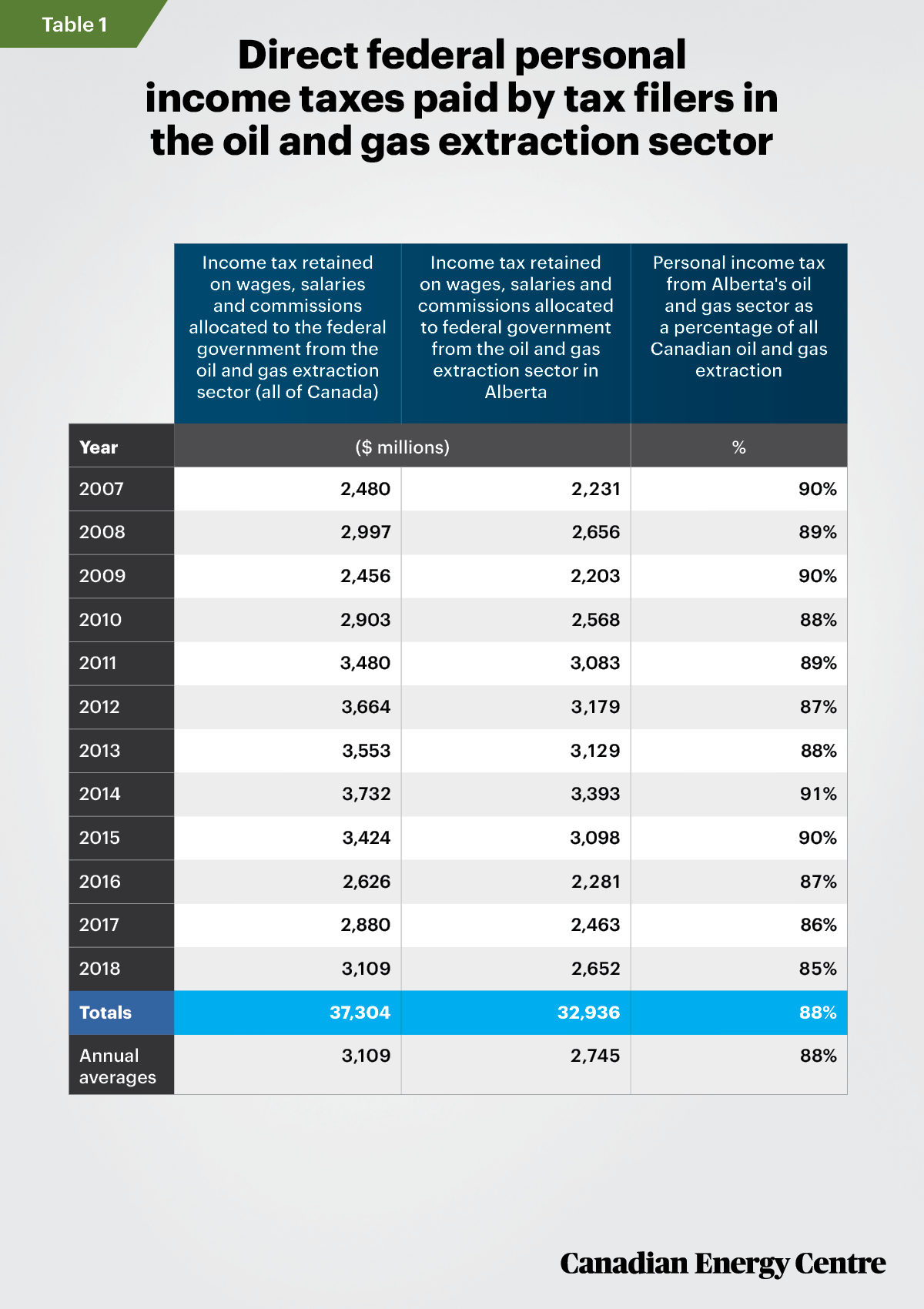

Total federal personal income taxes or direct taxes from tax filers employed in the oil and gas extraction sector in Canada has ranged from about $2.5 billion to $3.7 billion between 2007 and 2018 (see Table 1).

To determine the share of federal direct taxes in Alberta raised from oil and gas extraction, we examine the federal income tax retained on wages, salaries and commissions, as derived from a custom tabulation drawn from the Statistics Canada T1 Family File.

Federal personal income taxes paid by tax filers employed in the oil and gas extraction sector in Alberta has ranged from $2.2 billion to $3.4 billion between 2007 and 2018, or an annual average of $2.7 billion per year over the period. This represents about 88 per cent on average of federal income taxes retained on wages, salaries and commissions from tax filers in Canada employed in the oil and gas extraction sector over the period.

The high degree of variability likely reflects, in part, the impact of changing fortunes for the oil and gas extraction sector on the federal government’s personal income tax base in Alberta, including the impact of the Great Recession that began in 2009 and the energy price decline that began in 2014.

4. The net fiscal contribution can also be calculated by adding indirect taxes paid by the oil and gas sector but we have not done so in this Fact Sheet where we profile only direct taxes. 5. As per footnote 4.

Derived from Statistics Canada. Table 11-10-0073-01 and Statistics Canada T1 Family File (custom tabulation).

Direct federal corporate income taxes from corporations

Federal corporate income taxes from corporations and business enterprises in the oil and gas extraction sector have ranged from $527 million to $3.9 billion between 2007 and 2018 (see Table 2).

Based on a custom tabulation from Statistics Canada, an annual average of between 79 per cent and 96 per cent of federal corporate taxes were collected from oil and gas extraction businesses in Alberta between 2007 and 2018.

Federal corporate taxes paid by businesses in the oil and gas extraction sector in Alberta have ranged from $414 million to nearly $3.8 billion between 2007 and 2018, or an annual average of $1.4 billion per year over the period.

As noted above, the high degree of variability likely reflects, in part, the impact of changing fortunes for the oil and gas extraction sector on the federal government’s corporate income tax base in Alberta, including the impact of the Great Recession that began in 2009 and the energy price decline that began in 2014.

Derived from various Statistics Canada sources: Table 33-10-0006-01; Financial and taxation statistics for enterprises, by industry type; Financial and taxation statistics for enterprises, by industry type (custom tabulation).

Takeaway: Putting it all together

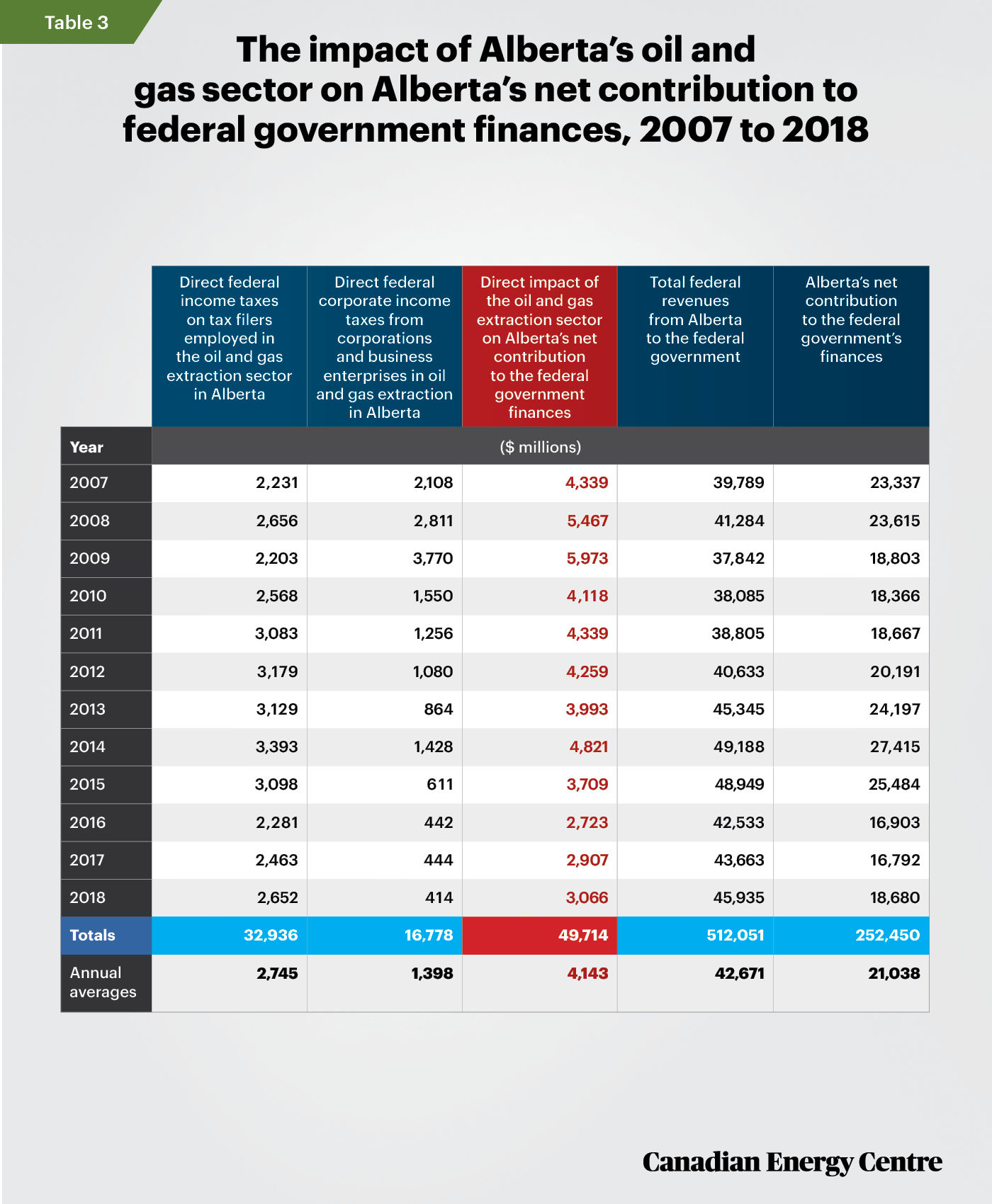

The direct impact of the oil and gas sector on Alberta’s gross and net contribution to federal government finances is significant. Between 2007 and 2018, the contribution was as follows (see Table 3):

- The sector contributed in total a minimum of nearly $50 billion of Alberta’s $512 billion in total revenue contribution to federal finances (an average of over $4.1 billion per year) or nearly 10 per cent of Alberta’s gross revenue contribution over the period;

- The $50 billion was nearly 20 per cent of Alberta’s total net fiscal contribution over the period;

- The $50 billion figure is understated as it does not include indirect federal taxes on production and taxes on products (i.e. GST, excise taxes, duties, import taxes, air transportation tax, gasoline and motive fuel taxes, etc.) paid by the oil and gas extraction sector in Alberta over the period.

Source: Derived from Statistics Canada, Table 36-10-0450-01; Table 11-10-0073- 01; Table 33-10-0006-01;) T1 Family File (custom tabulation); and Financial and taxation statistics for enterprises, by industry type (custom tabulation).

Notes

This CEC Fact Sheet was compiled by Lennie Kaplan and Mark Milke at the Canadian Energy Centre (www.canadianenergycentre.ca). There are differing methodologies used to calculate Alberta’s net fiscal contribution to federal finances. In this Fact Sheet, we use the methodology outlined by Alberta Treasury Board and Finance as per their 2012 paper, cited below, to construct the fiscal balance sheet. The authors and the Canadian Energy Centre would like to thank and acknowledge the assistance of an anonymous reviewer in reviewing the data and research for this Fact Sheet. Image credits: Parliament Hill in Ottawa Ontario by Pgaim from Getty Images.

Addendum and a caveat on net fiscal contributions to federal government finances

This use of Statistics Canada data to calculate net flows between federal government expenditures in provinces and revenues from the same has limitations. Readers should be aware that while the data can be used to show flows in general—Albertans through their federal personal and corporate taxes and other payments contribute in far higher proportions than their share of the national population—there are criticisms of more specific calculations. In a 2007 Statistics Canada article, analyst Steve West noted how federal transfer money sent to Atlantic Canada but which is then used to purchase medical equipment in Ontario makes the question of which province benefits more complicated. Also, as one of us has written in the past, it is unrealistic to expect that federal flows into provinces (spending on individuals, businesses, and others or federal transfers to provincial governments), will exactly replicate “outflows” from the same provinces. One reason for that is the example just noted but another is how Albertans, for example, when unemployment was lower than the national average, would have contributed more in employment insurance premiums to the federal government than were paid out in return, in the form of EI premiums, to unemployed Albertans. That scenario creates an obvious but entirely understandable imbalance between the two flows.

However, as one of us has also noted in a past study (Milke 2013), on the first example, “such different assignments are routine and expected and thus do not negate the possibility of using such data as a proxy in the absence of more detailed and precise data.” Relevant though to both examples is a follow-up point from the same study, “Moreover, such assignment of spending does not detract from how larger and more prosperous economies such as Alberta have economies that are significantly larger as a percentage of the national economy vis-à-vis their population (and thus are proportionately higher contributors to federal tax coffers when compared to say, Quebec).”

For our purposes, despite the limitations in the data—readers should think of the available data as a proxy and as indicative of trends—what is clear is that tax and other payments from the Alberta oil and gas sector (and from other Alberta businesses and individuals) are substantial. Measured on a net basis and on a net per capita basis (and with comparisons to net contributions from other provinces’ individuals and corporations profiled in studies noted in the above paragraph and next), the flows demonstrate the significance and importance of both the oil and gas sector and Alberta to the national economy and federal revenues. This is an observation that has also been made by others. They include Ben Eisen et al., in a 2019 study and Robert Mansell et al., in a 2020 study.

Sources (Links live as of October 1, 2020)

Alberta (undated). Oil [and natural gas] prices [downloaded CVS file]. <https://bit.ly/2FK1Cg7>; Alberta Finance (2012), Albertan’s Net Contribution to Confederation for 2011, <https://bit.ly/3jlWhKH>; Eisen, Ben and Steve Lafleur and Milagros Palacios (2019). How Albertans Continue to Keep Federal Finance Afloat <https://bit.ly/34dXIo9>; Eisen, Ben and Lafleur, Steve and Palacios, Milagros (2020). A Friend in Need: How Albertans Continue to Keep Federal Finances Afloat. <https://bit.ly/2SgD9BN>: Mansell, Robert and Mukesh Khanal and Trevor Tombe (2020). The Regional Distribution of Federal Fiscal Balances: Who Gets, Who Pays, and Why It Matters. <https://bit.ly/3l3YpHj>; Milke, Mark (2013). Super-sized fiscal federalism. <https://bit.ly/2HOeYc4>; Statistics Canada. Table 11-10-0073-01 Wages, salaries and commissions of tax filers aged 15 years and over by main industry sector and sex, <https://bit.ly/2ZZpQtP>; Statistics Canada (undated). Table 33-10-0006-01 Financial and taxation statistics for enterprises, by industry type, <https://bit.ly/2HkMztY>; Statistics Canada (undated). Table 36 10-0450-01, Revenue, expenditure and budgetary balance – General governments, provincial and territorial economic accounts, <https://bit.ly/33InsZy>; Statistics Canada (2019) Supply and Use Tables, <https://bit.ly/32NnIau>; Statistics Canada, Financial and taxation statistics for enterprises, by industry type, custom tabulation; Statistics Canada T1 Family File of the Centre for Income and Socio-Economic Well-Being. Annual Income Estimates for Census Families and Individuals (T1 Family File), custom tabulation; West, Steve (2007). Federal Government Revenue and Spending by Province: A Scorecard of Winners and Losers in Confederation? Statistics Canada, Canadian Economic Observer February 2007, 3.1, <https://bit.ly/33hv9qD>; Statistics Canada (2020), Table 17-10-0005-01, Population estimates on July 1st, by age and sex, <https://bit.ly/3n3NBuN>.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms with attribution to the CEC. Attribution and specific restrictions on usage including non-commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial-NoDerivs CC BY-NC-ND.