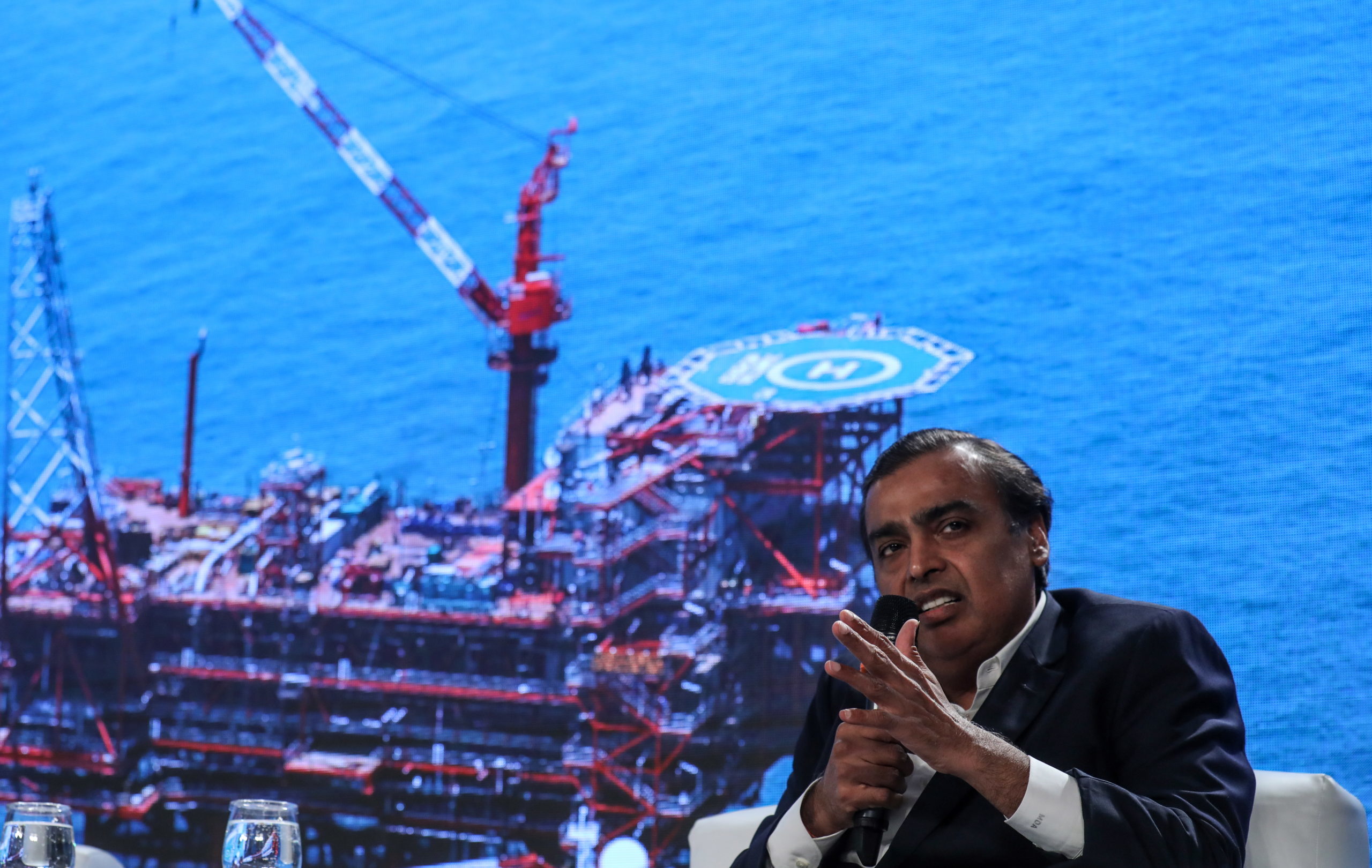

The growing global appetite for Canadian heavy oil is on clear display with a new major monthly purchase by Indian oil refiner Reliance Industries.

Reliance will reportedly import two million barrels per month from Canada to replace supplies from Venezuela as the country’s production levels approach zero.

Many refineries around the world are tailored to process heavy oil, which only comes from a handful of jurisdictions. Resources in Canada and Venezuela are the largest.

“Everybody wants our heavy oil. We’ve got a long-term supply of it, and getting it from elsewhere is becoming less reliable,” says Tim Pickering, president of Calgary-based Auspice Capital Advisors.

“I think we’re going to see more demand for Canadian oil, and that will start to pick up as the possibility of getting it to tidewater starts to be a reality.”

Venezuela production approaching zero

One of the founding members of OPEC, Venezuela is currently experiencing an unprecedented decline in oil production, according to analysts with IHS Markit.

Production was around 650,000 barrels per day a year ago, and has been as high as two million barrels per day as recently as 2017. But as of August 2020 it had dropped to as low as 100,000 barrels per day, IHS Markit said.

Analysts attribute the fall to decades of decline and decay, exacerbated by the U.S. sanctions that started in 2019 and the COVID-induced oil price collapse.

“Any recovery would take a considerable amount of time given the degree of dilapidation throughout the country’s energy infrastructure,” said Ha Nguyen, IHS Markit’s director of global oil supply. “It looks like close-to-zero oil production is Venezuela’s new normal for the foreseeable future.”

In contrast, Canadian oil production is expected to continue growing.

Growth in Canadian oil production, India’s demand

OPEC’s new 2020 World Oil Outlook forecasts that Canadian oil production will increase from 5.4 million barrels per day in 2019 to 6.2 million barrels per day in 2045. That’s primarily from the country’s vast oil sands resources, which produce heavy oil as well as light synthetics.

While oil demand continues to rise, Canada is one of only a handful of jurisdictions outside of OPEC that are expected to see meaningful production growth post-2025. OPEC forecasts that global oil demand will increase from 99.7 million barrels per day in 2019 to 109.1 million barrels per day in 2045.

The largest contributor to the demand growth is anticipated to be India, which currently gets the majority of its oil supply from Saudi Arabia and Iraq, according to the U.S. Energy Information Administration. OPEC forecasts that India’s demand will increase by 6.3 million barrels per day between 2019 and 2045, driven by an expanding middle class, high population growth rates and stronger economic growth potential.

“The interest in getting the heavy oil molecules from Canada has just continued to increase in Asia, especially with how Venezuela is just no longer really a secure source and the supply is just dwindled, and Mexico is now becoming less secure,” says Phil Skolnick, analyst with Eight Capital.

Market pull

Mexico, which along with Venezuela has been a key heavy oil supplier to the massive U.S. Gulf Coast refining cluster, has seen steady production declines since 2005. State-run company Pemex reported 1.7 million barrels per day of production in August 2020, down significantly from its peak of 3.8 million barrels per day in 2004.

Meanwhile, Canadian oilsands production has been growing (2.9 million barrels per day in 2019 compared to 1.0 million barrels per day in 2004). Incremental pipeline access and crude-by-rail have allowed more Canadian heavy oil to reach the U.S. Gulf Coast, helping displace crude from Venezuela and Mexico.

U.S. Gulf Coast imports of Canadian oil increased from approximately 82,000 barrels per day in December 2006 to 570,000 barrels per day in July 2020, according to the U.S. Energy Information Administration.

“The Gulf Coast is becoming a bigger consumer of Canadian heavy oil, especially because of Venezuela and Mexico,” Skolnick says.

The outlook is positive for Canadian oil in the future, he says, especially once the Trans Mountain Pipeline Expansion and Keystone XL are completed.

“It’s really going to be interesting because if you get TMX online, then you’re having this pull between Asia, PADD II [the U.S. Midwest] and PADD III [the U.S. Gulf Coast]. We still believe that could cause Canadian heavy oil to trade at a premium to WTI.”