Rising demand, high commodity prices and concerns about energy security have driven up share prices in Canada’s oil and gas sector, and investors are reaping the benefits.

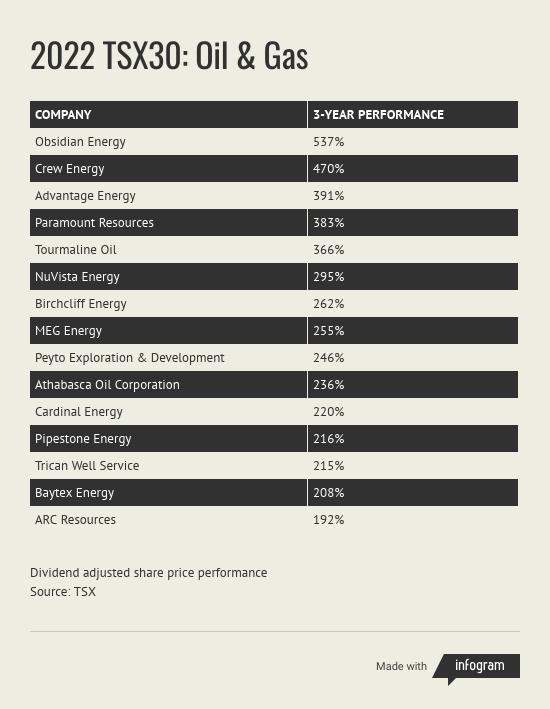

Divestors, on the other hand, have missed out on the extraordinary three-year returns in the oil and gas space as measured and ranked by the TSX. Fifty per cent of the companies on the recently released TSX30 are in the oil and gas sector – 14 producers and one oilfield service company.

The TSX30 is an annual ranking of the top-performing stocks on the Toronto Stock Exchange over a three-year period, based on dividend-adjusted share price performance.

The average share price return for the oil and gas companies on this year’s list was 299 per cent. Not to mention that the second top performing sector was mining, which could not function without oil and gas.

Can public sector investment funds (like university endowments and pension plans) and their divestment decision-makers continue to ignore the significant value in the energy space?

The divestment folly is that issuing blanket mandates to eschew the oil and gas sector and to remove its companies from the investment pool does nothing to foster innovation nor reduce emissions.

Divestment goes counter to fiduciary duty, which obliges trustees to act in the best interest of their trust beneficiaries, maximizing the risk-adjusted return for investments.

Divestment from Canadian oil and gas companies does not stop oil and gas production or reduce emissions because it does nothing to reduce global demand.

After more than a decade of divestment pledges, world oil and gas consumption has gone up and emissions have gone up along with it.

Innovative, responsible Canadian companies like the ones who made the TSX30 list should be the ones to supply the oil and gas to meet the ever-rising needs of the world’s growing population.

There are some investment funds that are taking a different tact with respect to divestment.

Evan Siddall, CEO of AIMCo, one of Canada’s largest institutional investment managers said in a recent Globe and Mail article that “selling off fossil-fuel producers is out of the question.”

The CEO of the $168 billion fund does not believe in divestment as a strategy to balance energy supply and emission reduction in its investment decisions. Siddall believes that the key to achieving the balance is to invest in the Canadian oil and gas sector.

In the spring of 2021, John Graham, CEO of CPPIB, Canada’s largest pension fund, said that under his watch, “fossil fuel divestment is off the table as it would be a short on human ingenuity.”

CPPIB is making investments in the entire energy ecosystem and is not pursuing a path of blanket divestment.

Investing in the Canadian oil and gas sector means investing in ethical energy companies that have high environmental and governance standards; that are innovative and concerned with emissions reductions; and that, lately, have some of the strongest returns on the TSX.

Gina Pappano is the former head of market intelligence at the Toronto Stock Exchange and executive director of InvestNow Inc., a non-profit dedicated to demonstrating that investing in Canada’s resource sectors helps Canada and the world. Join the movement and pass the InvestNow resolution at investnow.org.

The unaltered reproduction of this content is free of charge with attribution to Canadian Energy Centre Ltd.